Faraday Future Successfully Launches Three EAI Robotics Product Series at NADA Show 2026

Robotics debut strengthens Faraday Future’s EAI and bridge strategies while accelerating dealer engagement and FX Super One rollout

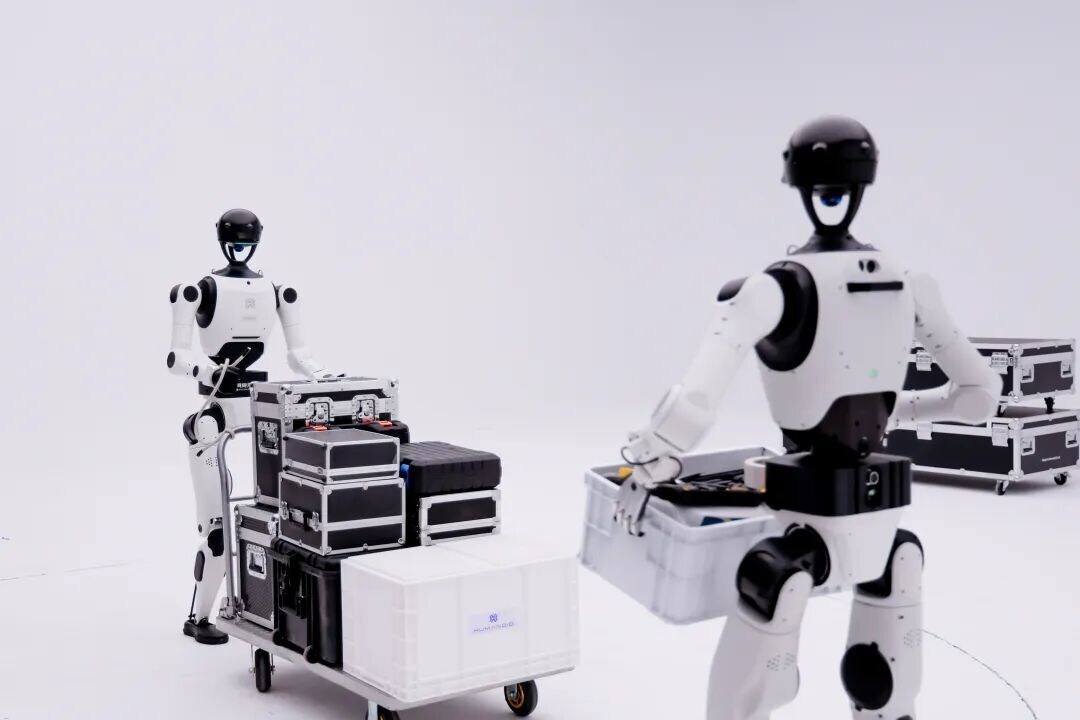

- FF successfully launched three series of robot products in Las Vegas at the annual NADA Show last week.

- Newly announced robotics business upgrades FF’s overall EAI strategy and bridge strategy, strengthening the Company’s existing vehicle business.

- On February 5, FF successfully hosted a dealer summit for FX Super One and FF EAI robotics. Dozens of automotive dealers from across the United States attended the event and expressed interest in FF’s proprietary FF Par sales model. Multiple dealers have already clearly expressed their intent to enter into comprehensive “robot & vehicle +” cooperation agreements.

- FX Super One will roll out SOD Phase 1 in Q2. At the same time, FF’s robotics business is set to start deliveries by the end of February.

Faraday Future Intelligent Electric Inc. (NASDAQ: FFAI) (“Faraday Future”, “FF” or the “Company”), a California-based global shared intelligent electric mobility ecosystem company, shared a weekly business update from YT Jia, Founder and Global Co-CEO of FF.

“This week, the launch of FF’s EAI Robotics products generated stronger-than-expected engagement. We trended at the top of major platforms across multiple channels. Thank you, sincerely, for following our progress and for your support of FF and me. I believe FF’s operating fundamentals are improving.

That said, in the capital markets, recent broad volatility has driven short-term sentiment swings. FFAI experienced a substantial increase in trading volume and short selling, and our share price experienced abnormal volatility and closed below $1.00 the last two trading days.

Our EAI Robotics strategy has been very well received in the private markets, with overall recognition meaningfully stronger than what we saw in the public market this week. In other words, the feedback from the private market and the public market was completely opposite. I want to reflect on this: we did not communicate and explain the strategy clearly enough to the public, and that information gap led to deeper concerns and even misunderstandings. I’ve seen comments such as: “Are you getting distracted again?” “Is FF no longer focused on vehicles?” or “Is something wrong with the vehicle business?”

The answer to each question is “no.” Our robotics business is an upgrade to our overall EAI strategy and our bridge strategy. It does not distract us from our vehicle business. Rather, we believe it can empower the vehicle business across multiple dimensions, including business execution, capital strategy, financial structure, product, and technology, among others.

Here comes a big teaser, on the same day of the robotics event, we achieved a milestone relating to the Super One. We will announce the full details after market close next Tuesday. Stay tuned.

We firmly believe that with the build-out of our Dual-Bridge, Dual-Flywheel, Dual-Public-Company ecosystem, and with EAI EV and EAI Robotics now both activated, FFAI has undergone a fundamental and systemic upgrade. We are highly confident that this year will be FF’s momentum-building year, and we are going all-in to position FF to take off next year. We firmly oppose any stock split and will be prudent with our equity issuances. We remain committed to putting stockholders first and will do everything we can to safeguard stockholder interests.

We believe that as our business executes, delivers, and makes tangible progress, the strategy will become clearer—and many investors will return to support us. We will do everything we can to create greater value for stockholders.

We will take four major initiatives to protect our stockholders:

1. I affirm once again: FF firmly opposes any reverse stock split, unless required to comply with Nasdaq’s continued listing standards. We remain fully committed to maintaining or timely regaining listing compliance as a public company and delivering value to stockholders, continuing to strengthen our response in the battle against malicious short selling, accelerating FF’s value return, and narrowing the gap between capital market valuation and intrinsic business value—while striving to create even greater breakthroughs. Under Nasdaq regulations, if the closing share price remains below $1 for more than 30 consecutive trading days, a deficiency notice is automatically triggered, and the Company is granted no less than 180 days to regain listing compliance. We firmly believe that our four key initiatives will enable the Company to continuously strengthen its operating fundamentals while maintaining more effective and transparent communication with our stockholders and retail investors, thereby ensuring that reducing the likelihood that the Company does not trigger any Nasdaq compliance issues.

2. From a mid to long-term perspective, the robotics business could serve as a new source of cash inflow and a new growth curve, enabling FFAI stockholders to capture long-term value from the next significant market opportunity, while also potentially providing greater financial flexibility and strategic support for the vehicle business.

3. At the business level, we are accelerating the mutual empowerment between our vehicle and robotics businesses under a “dual-engine EAI framework”. From our perspective, vehicles and robots have evolved into fundamentally similar products—both are EAI terminals. As a result, there’s significant overlap across R&D, sales, and service, allowing the two businesses to generate strong synergies.

The significant progress we have made at the NADA Show has further reinforced our confidence that this is a mutual empowerment rather than one business coming at the expense of the other. On February 5, we successfully hosted a dealer summit for FX Super One and FF EAI robotics. Dozens of automotive dealers from across the United States attended the event and expressed interest in FF’s proprietary FF Par sales model. Multiple dealers have already clearly expressed their intent to enter into comprehensive “robot & vehicle +” cooperation agreements. Notably, many U.S dealers, driven by strong interest in robotics collaboration, have further deepened their engagement with our vehicle business. This is a clear demonstration of how the robotics business can in turn empower the vehicle business, and we believe it serves as one of the strongest validations of our innovative model and differentiated products.

4. We will continue to enhance transparent communication with our stockholders and retail investors, helping the market better understand the unique advantages and intrinsic value of our strategy and business model. At the same time, if you become aware of any potentially illegal short-selling activity, we encourage you to reach out to us immediately.

FX Super One will roll out SOD Phase 1 in Q2. At the same time, our robotics business is set to start deliveries by the end of February, initially targeting high-frequency scenarios with the greatest potential for scale and market impact—such as dealership and showroom reception, as well as home security. The goal is to go deep, make it comprehensive, and establish benchmark use cases.

This year, we will remain fully committed to executing relentlessly on the homologation, initial production, and delivery of FX Super One, as well as sales and deliveries of our robotics products. We will remain focused on strengthening both our operating and capital fundamentals, while going all out to maximize value for our stockholders.”