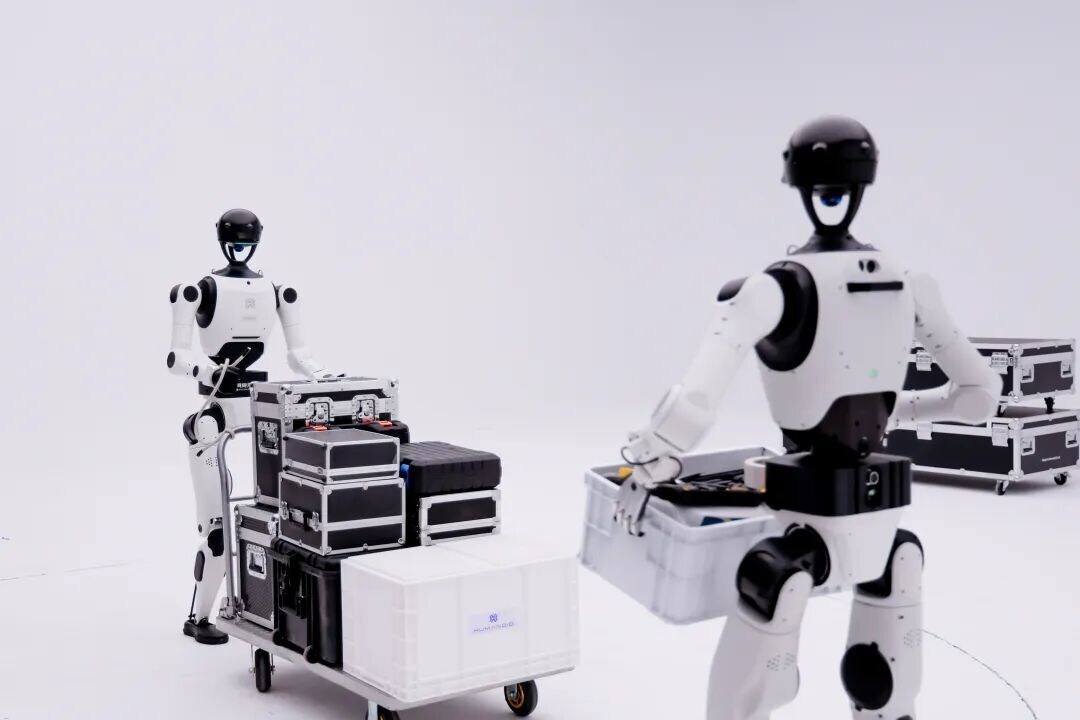

China’s Cheetah Mobile Acquires Majority Stake in UFACTORY to Advance Global Expansion in Collaborative Robotics

With a 75.8% ultimate ownership, the RMB99.5M deal strengthens Cheetah Mobile’s robotics portfolio and supports its strategic push into AI-driven service robots operating across diverse physical environments.

Image Courtesy: Public Domain

Cheetah Mobile Inc. a China-based IT company, announced that one of its majority-owned subsidiaries has signed a definitive agreement to acquire an equity interest of 60.8% in Shenzhen UFACTORY Technology Co., Ltd. ("UFACTORY"), a leading provider of lightweight robotic arms, for a total consideration of approximately RMB99.5 million. Prior to the transaction, another wholly-owned subsidiary of Cheetah Mobile already held 19.2% of UFACTORY's total equity interest. Following the transaction, the two subsidiaries will collectively hold approximately 80.0% of UFACTORY's total equity interest, representing Cheetah Mobile's ultimate beneficial ownership in UFACTORY of approximately 75.8%.

The transaction has been approved by the Company's board of directors and audit committee and is expected to close in the third quarter of 2025, subject to customary closing conditions.

Mr. Sheng Fu, Cheetah Mobile's Chairman and Chief Executive Officer, commented, "We're excited to deepen our investment in UFACTORY, a fast-growing leader in collaborative robotics. With its robust technology stack and lean go-to-market approach, UFACTORY is an ideal partner to support our next stage of growth in AI and robotics. With this acquisition, we're strengthening our product portfolio to help our service robots operate across more physical environments and tasks. This marks a significant step forward in our mission to deliver smarter, more adaptable robotics solutions to global markets."

Mr. Thomas Ren, Cheetah Mobile's Director and Chief Financial Officer, commented: "We will fund the acquisition with our cash reserves. As of March 31, 2025, we held over USD230 million in net cash, giving us ample flexibility to pursue strategic investments that have the potential to deliver sustainable shareholder value."