Humanoid & Embodied AI Robotics Market Surges Toward US$34.3 Billion by 2032, Driven by Breakthroughs in AI, Automation and Industrial Deployment

With a rapid 29.5% CAGR, the global humanoid and embodied AI robotics market is expanding across manufacturing, healthcare, logistics and retail as multimodal AI, autonomous mobility and human–robot interaction accelerate adoption, supported by major developments from Tesla, Figure AI, Agility Robotics, Honda, Toyota and SoftBank.

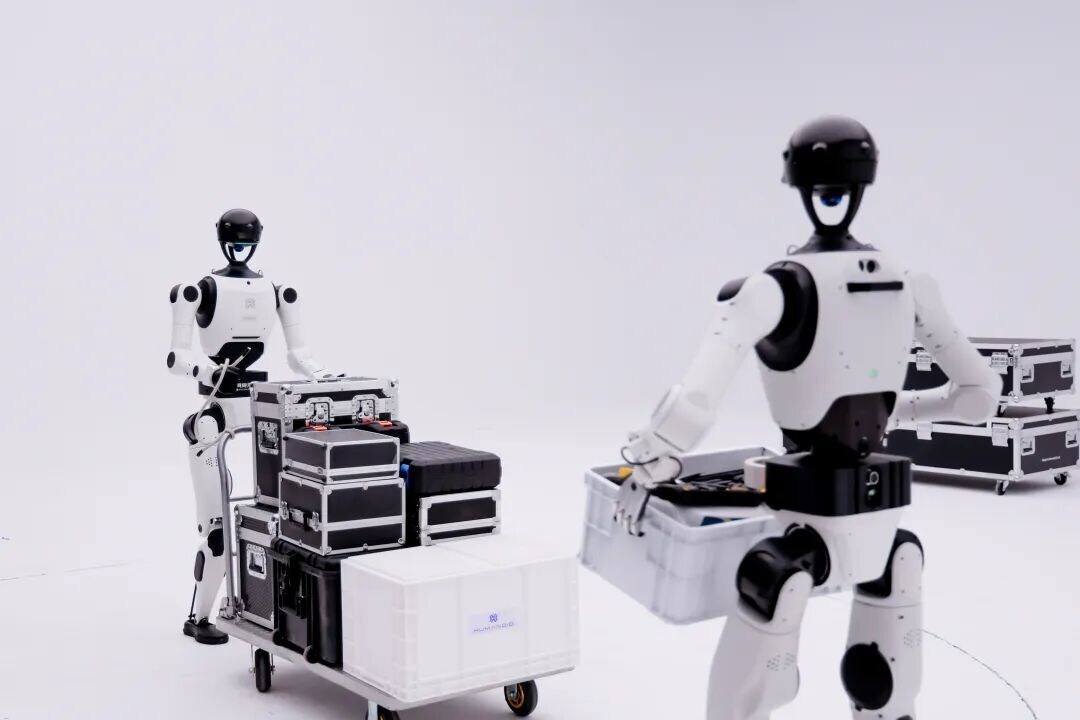

Image Courtesy: Public Domain

The humanoid & embodied AI robotics market is growing at 29.5% CAGR, driven by AI advances and automation demand across manufacturing, healthcare and logistics.

The humanoid & embodied AI robotics market reached US$3,355.56 million in 2023, increased to US$4,345.45 million in 2024, and is expected to reach US$34,371.06 million by 2032, registering a strong CAGR of 29.5% from 2025 to 2032, according to DataM Intelligence. These accelerating values underscore the rapid shift toward advanced robotics systems capable of combining physical embodiment with cognitive intelligence.

This extraordinary growth trajectory reflects rising demand for robots that can autonomously navigate, interact with humans, and perform complex tasks across real-world environments. Breakthroughs in artificial intelligence, machine learning, motion control, and human robot interaction are enabling humanoid robots to become valuable workforce companions in manufacturing, logistics, retail, healthcare, hospitality, and household applications. As organizations intensify their automation initiatives and seek intelligent robotic solutions that mirror human-like capabilities, the market for humanoid and embodied AI robotics continues to expand at an unprecedented pace.

The market’s growth is propelled by increasing enterprise investments, rapid advancements in AI-driven dexterity, and rising demand for automated solutions that can safely work alongside humans. Humanoid robots form the leading segment due to their anatomical design, contextual understanding, and adaptability making them suitable for customer service, assembly operations, rehabilitation support, and warehouse automation. North America currently leads the global market, supported by a strong innovation ecosystem, robotics startups, and early-stage industrial deployments, while Asia-Pacific remains the fastest-growing region owing to aggressive automation programs in China, Japan, and South Korea.

Key Highlights from the Report

➤ The market is expected to surpass US$34 billion by 2032 due to accelerated adoption of embodied AI systems.

➤ Humanoid robots dominate the product landscape owing to their versatility, mobility, and human-like interaction capabilities.

➤ Rapid rise in enterprise automation is boosting demand for AI-powered robots in manufacturing and logistics.

➤ Asia-Pacific remains a key growth hub driven by government-led automation initiatives and industrial modernization.

➤ Advancements in multimodal AI significantly enhance robots’ decision-making, object manipulation, and social interaction abilities.

➤ Healthcare and retail sectors are witnessing major deployments of service humanoid robots for support and engagement tasks.

Recent Developments:

United States: Recent Industry Developments:

1. In October 2025, Tesla Optimus completed large-scale pilot deployment across Tesla’s Gigafactories, assisting in material handling and quality inspections. The rollout demonstrated a 30% efficiency improvement in repetitive workflows.

2. In September 2025, Figure AI announced a strategic partnership with OpenAI and Microsoft to integrate advanced multimodal reasoning into Figure 02 robots, enabling natural language task execution and self-improving learning loops.

3. In August 2025, Agility Robotics expanded commercial production of its Digit humanoid robot at its Oregon factory—one of the world’s first purpose-built humanoid manufacturing facilities supporting logistics and fulfillment operations for major U.S. retailers.

Japan: Recent Industry Developments:

1. In October 2025, Honda’s 5th-generation ASIMO platform was upgraded with enhanced dexterity, enabling precision assembly and elder-care assistance. The company also initiated long-term trials in healthcare facilities.

2. In September 2025, Toyota Research Institute (TRI) unveiled its next-gen embodied AI system, allowing robots to perceive, map, and generalize household tasks using foundation-model-based intelligence.

3. In August 2025, SoftBank Robotics launched the “Advanced Pepper-H” initiative, integrating humanoid robots with emotional AI engines to support customer experience roles in retail, hospitality, and banking sectors.

Company Insights:

• Tesla

• Boston Dynamics

• Agility Robotics

• Sanctuary AI

• Figure AI

• Fourier Intelligence

• Xiaomi Robotics

• UBTECH Robotics

• SoftBank Robotics

• Engineered Arts

• PAL Robotics

• Apptronik

• Hanson Robotics

Market Segmentation:

The humanoid & embodied AI robotics market is structured across product types, components, applications, and end-user industries.

By product type, the market includes humanoid robots, service robots, social robots, rehabilitative robots, autonomous embodied agents, and industrial assistance robots. Humanoid robots hold the lion’s share due to their ability to mimic human movement patterns, navigate human-designed environments, and interact naturally through voice, gestures, and facial expressions.

By component, the market is segmented into hardware, software, and services. Hardware encompasses actuators, AI processors, sensors, power systems, and mechanical frames, whereas software includes multimodal learning systems, motion controllers, navigation algorithms, and reinforcement learning modules. Software is becoming increasingly critical, enabling robots to reason, adapt, perceive depth, and perform tasks autonomously. The service layer covers deployment support, integration, training, and lifecycle maintenance.

By application, humanoid and embodied AI robots serve diverse roles in manufacturing automation, healthcare assistance, human–robot interaction, warehouse material handling, hospitality services, education, entertainment, and home robotics. Healthcare and logistics are the highest-value segments due to rising demand for rehabilitation robots, patient assistants, autonomous mobile robots, and humanoids supporting nursing workflows and warehouse operations.

By end-user, the market covers industries such as automotive, electronics, retail, healthcare, defense, research institutions, and consumer households. Industrial sectors currently dominate, although the consumer segment is projected to accelerate as humanoid household assistants become commercially viable.

Regional Insights

North America leads the global humanoid robotics market, driven by advanced AI capabilities, the presence of major robotics innovators, and large-scale adoption in the manufacturing and healthcare sectors. Companies in the U.S. are actively piloting humanoid robots for assembly line support, warehouse tasks, and customer-service roles, supported by a strong startup ecosystem and growing investor interest.

Europe follows closely, benefiting from a robust industrial base, initiatives supporting human–robot collaboration, and strong safety and compliance frameworks that guide the deployment of embodied AI systems. Germany, France, and the U.K. are at the forefront of integrating humanoid robots into industrial and service sectors.

Asia-Pacific is the fastest-growing regional market, fueled by massive automation efforts in China, Japan, and South Korea. Japan has long pioneered humanoid robotics research, while China is aggressively expanding manufacturing automation and large-scale production of commercial humanoids. South Korea continues to strengthen its robotics capabilities through government incentives, R&D funding, and research partnerships.

Emerging economies across Latin America and the Middle East & Africa are increasingly exploring embodied AI solutions in areas such as security, logistics, and smart city infrastructure. Although adoption remains at an early stage, growing urbanization and technology investments will drive significant long-term opportunities.

Market Dynamics

Market Drivers

The surge in adoption of humanoid and embodied AI robotics is primarily fueled by rapid advancements in AI, including multimodal learning, vision-language-action models, and reinforcement learning. As labor shortages intensify globally, particularly in manufacturing, logistics, and healthcare, robots capable of performing repetitive, hazardous, or physically demanding tasks are gaining prominence. Companies are also prioritizing safety and operational efficiency, encouraging the use of AI-powered robots that can collaborate with human workers without compromising safety. The expansion of smart factories, digital twins, and IoT ecosystems further supports market acceleration by enabling seamless robotic integration.

Market Restraints

High development and deployment costs remain a considerable barrier, especially for small and medium enterprises. Humanoid robots require sophisticated actuators, durable materials, advanced AI processors, high-density batteries, and complex software architectures—all contributing to elevated price points. Additional restraints include regulatory challenges, safety certification requirements, and public apprehension regarding humanoid robots in sensitive environments. Furthermore, current robots still face limitations in dexterity, social intelligence, and long-duration autonomy, which may slow adoption in some sectors.

Market Opportunities

The market presents significant opportunities as robots become more dexterous, autonomous, and emotionally intelligent. Healthcare is one of the most promising fields, with demand rising for robots capable of patient interaction, rehabilitation support, and elderly care. Retail and hospitality also offer strong potential as businesses seek interactive humanoids for customer engagement, concierge services, and operational assistance. The emergence of the consumer humanoid robot market represents a major upcoming opportunity, especially as home-based assistants and embodied AI companions become an affordable reality. Additionally, large enterprises are increasingly exploring humanoids for warehouse automation, last-mile logistics, and assembly-line support, unlocking massive commercial potential.