Serve Robotics Acquires Vayu Robotics to Advance AI-Powered Autonomous Delivery

By integrating Vayu’s foundation model expertise and simulation-driven data engine with its proven sidewalk delivery platform, Serve strengthens its leadership in last-mile autonomy, accelerates new use cases, and positions itself for rapid global expansion.

Image Courtesy: Public Domain

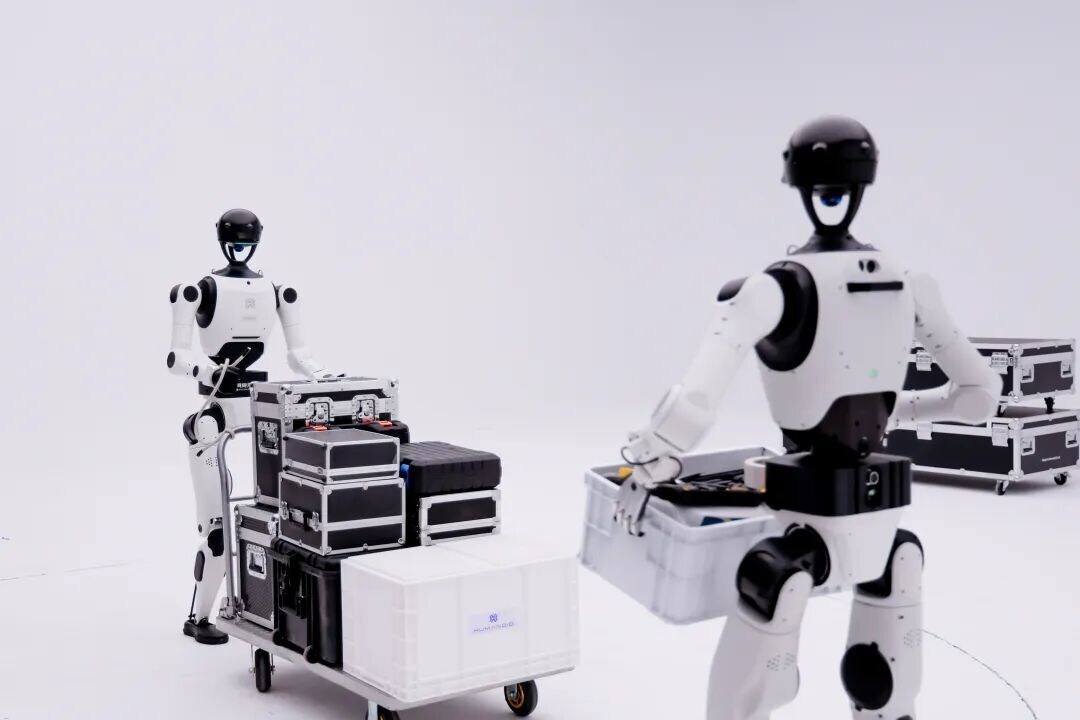

Serve Robotics Inc. a leading autonomous sidewalk delivery company (“Serve”), has acquired Vayu Robotics, Inc. (“Vayu”), a pioneer in urban robot navigation using large-scale AI models.

The strategic acquisition marks a milestone in Serve’s mission to redefine the future of autonomous delivery. As “physical AI” gains unprecedented momentum, acquiring Vayu positions Serve at the forefront of this paradigm shift in the robotics industry.

Serve’s delivery robots have set the industry benchmark for last-mile autonomy performance, successfully navigating complex, dynamic environments in urban settings. By combining Serve’s autonomy stack and unrivalled real‑world sidewalk dataset with Vayu’s expertise in AI foundation models and its scalable simulation-powered data engine, Serve is positioned to train more capable models through the fusion of real and simulated data — unlocking safer, faster, and more generalizable navigation while accelerating entry into new geographies and use cases.

The combination of Serve and Vayu is expected to:

- Accelerate Serve’s roadmap and bring new capabilities enabled by Vayu’s interpretable, foundation-model-driven robot navigation to Serve’s third-generation robots powered by the NVIDIA Orin edge AI platform.

- Expand Serve’s autonomy training capabilities by integrating high-speed, photorealistic simulation engine that complements Serve’s real-world dataset to enable scalable, diverse, and edge-case-rich AI training.

- Enable possible expansion into new delivery use cases and operating environments (such as bike lanes and road margins), facilitating faster entry into new customer categories, geographic regions and driving additional revenue and customer growth.

- Enhance safety, reliability and speed to further improve operation cost across Serve’s growing fleet.

Vayu’s multidisciplinary team of exceptional engineers from top-tier institutions, pedigreed researchers, and seasoned business leaders join Serve with decades of experience in developing and commercializing advanced technologies across autonomous vehicles and robotics. Vayu’s founders Anand Gopalan, Mahesh Krishnamurthi and Nitish Srivastava bring unique perspectives shaped by their deep expertise in AI and machine learning, hardware systems, and large-scale production.

In addition, legendary Silicon Valley technologist and Vayu’s lead investor Vinod Khosla will join Serve’s Advisory Board to support its mission of bringing robots to cities across the world.

“With this acquisition, Serve solidifies its leadership position, not just in current robotic delivery operations, but in shaping the future of autonomous robotic navigation. This step marks a significant milestone in Serve’s roadmap toward wide-scale deployment of autonomous robots on sidewalks across the nation, aligning with industry predictions of rapid robot adoption,” said Dr. Ali Kashani, CEO and co-founder of Serve Robotics. “Autonomy is critical to our long-term goal of bringing delivery costs down to $1, and these new capabilities will help us move faster.”

“We are thrilled to join the Serve team and apply our AI foundation model technology, talent and expertise to accelerating the development of their autonomous delivery platform,” said Anand Gopalan, CEO of Vayu Robotics. “Serve is differentiated by unmatched operational depth, a proven ability to deploy robots at scale, and a relentless focus on driving down cost per delivery through autonomy. Combined with a strong balance sheet and a bold, clear-eyed vision, Serve is uniquely positioned to lead the future of last-mile logistics. We’re proud and excited to be building that future together.”

“AI models are driving a new class of robotics across a range of industries,” said Vinod Khosla, founder of Khosla Ventures. “We invested early in Vayu because last-mile delivery stood out as one of the applications where autonomous delivery robots could create immense value. Today’s acquisition combines Vayu’s technological breakthroughs with Serve’s large footprint to accelerate faster, safer and more cost effective delivery.”

Financial Consideration

The acquisition was completed for upfront initial consideration payable to Vayu stockholders of 1,696,069 shares of Serve’s common stock (“Common Stock”), subject to customary purchase price adjustments and including vested, in-the-money options. An additional future earnout of 560,000 shares of Common Stock may be payable to Vayu stockholders and Vayu debtholders, contingent on achieving certain autonomy performance milestones. Additionally, the acquisition consideration included warrants to purchase 4,000,000 shares of Common Stock at an exercise price of $10.36 per share, issued to the Vayu SAFE holder, Khosla Ventures.

Some Vayu stockholders may also receive cash in lieu of shares. The transaction includes customary representations and warranties of the parties and an escrow to cover any indemnifiable expenses or liabilities. The stock consideration received in the transaction is subject to a 180-day lockup and the warrant consideration received in the transaction is subject to a four-year lockup.

Following the acquisition, Serve will continue to have a strong balance sheet and expects to continue to have access to sufficient capital.