KraneShares Lists Global Humanoid & Embodied Intelligence ETF on Deutsche Börse Xetra

KBOT brings exposure to humanoid robotics and embodied AI to German investors through Xetra listing

Image Courtesy: Public Domain

KraneShares, a global asset manager known for its innovative exchange-traded funds (ETFs), announced the cross-listing of the KraneShares Global Humanoid & Embodied Intelligence Index UCITS ETF on Deutsche Börse Xetra, where it will trade under the ticker KBOT.

The Xetra listing brings to German investors the same globally recognized strategy known under the ticker KOID, which is already listed on Nasdaq, the London Stock Exchange, and Borsa Italiana. While the fund trades under the ticker KBOT in Germany, the ETF’s investment objective, index methodology, and underlying holdings are identical across all listings.

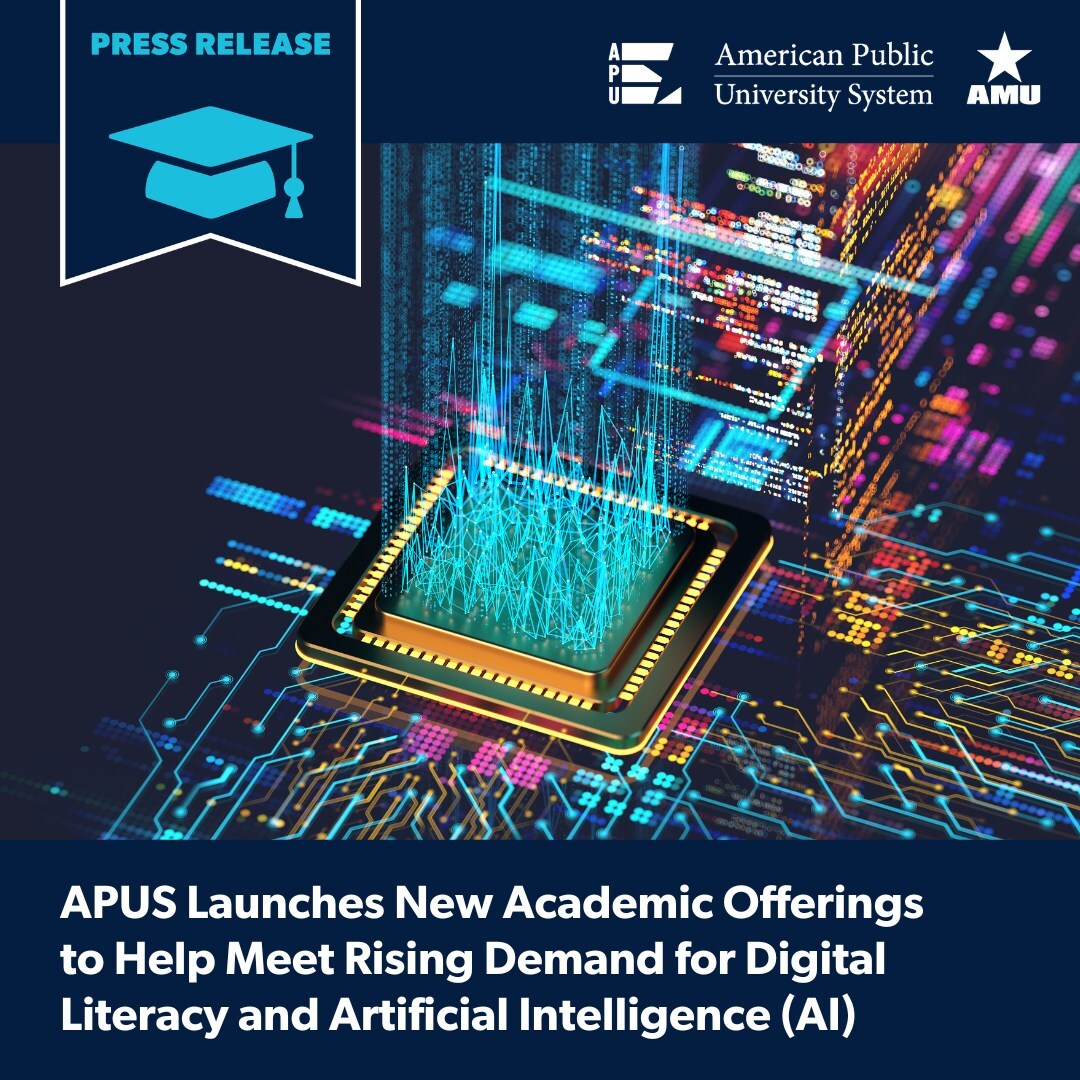

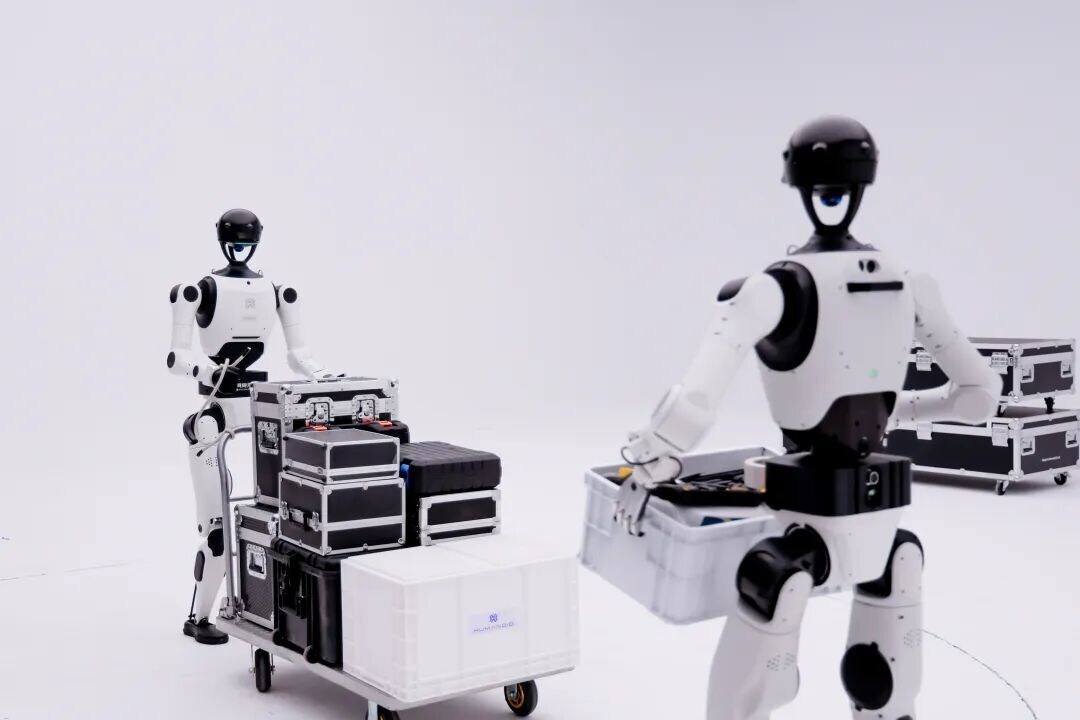

The KraneShares Global Humanoid & Embodied Intelligence Index UCITS ETF provides investors with targeted exposure to the rapidly expanding humanoid robotics and embodied intelligence ecosystem—an emerging industry at the intersection of robotics, artificial intelligence, and advanced manufacturing. The strategy offers a diversified portfolio of companies developing humanoid robots, as well as the critical enabling technologies behind them, including sensors, actuators, semiconductors, and the AI software that allows machines to perceive, learn, and interact with the physical world.

“We are pleased to bring our globally established humanoid and embodied intelligence strategy to Germany, one of the world’s most important markets for industrial automation and robotics innovation," said Dr. Xiaolin Chen, Head of International at KraneShares. "Germany’s leadership in manufacturing and automotive engineering positions it at the forefront of humanoid adoption, and the Xetra listing under KBOT provides German investors with a clear and efficient way to access this global growth theme.”

The ETF employs an equal-weight methodology, designed to deliver balanced exposure across the humanoid robotics value chain. Holdings include established global leaders such as Tesla and NVIDIA, alongside emerging innovators such as RoboSense, UBTECH, and Horizon Robotics. The portfolio also includes prominent German industrial and technology companies, including Infineon Technologies and Schaeffler, highlighting Germany’s integral role in automation and advanced manufacturing.

The listing comes as humanoid robots begin transitioning from research and pilot programs into real-world commercial deployment. Humanoids are increasingly being introduced across factories, logistics centers, healthcare settings, and service environments, helping address structural challenges such as labor shortages, aging populations, and workplace safety. Analysts, including Morgan Stanley, project that humanoids could number 1 billion units globally and generate up to $5 trillion in annual revenue by 2050, driven by adoption across multiple industries.¹