| Rank |

Company |

Focus & Notable 2024/25 Achievements |

| 1 |

Horizon Robotics |

AI Chips & ADAS. Completed Hong Kong’s largest tech IPO of 2024, raising HK$5.4 billion (~$696 million)[1]. Partnered with Volkswagen to integrate its autonomous driving “Superdrive” solution into VW models (Cariad JV)[2], solidifying Horizon’s role in automotive AI. |

| 2 |

Doosan Robotics |

Collaborative Robots (Cobots). South Korea’s biggest 2023 IPO, raising ₩421 billion (~$317 million)[3]. A leading cobot maker, now publicly listed, with major investors (GIC, Goldman Sachs) supporting expansion of its robot arms business. Poised to achieve break-even in 2024[4]. |

| 3 |

Ghost Robotics |

Quadruped Unmanned Ground Vehicles. Acquired by LIG Nex1 (S. Korea) which paid $240 million for a 60% stake[5], valuing Ghost at $400 million. Over 450 “Vision 60” dog-like robots sold (defense and security applications)[5][6], now set for accelerated growth under LIG Nex1. |

| 4 |

Rainbow Robotics |

Humanoids & Industrial Robots (S. Korea). Samsung Electronics invested ₩267 billion (~$181 million) to boost its stake to 35%[7], making Rainbow a subsidiary to spearhead Samsung’s humanoid robot ambitions. Rainbow (founded at KAIST) develops dual-arm humanoids and mobile manipulators, now backed by Samsung’s resources[8]. |

| 5 |

Kodiak Robotics |

Autonomous Trucks. Announced a definitive agreement to go public via SPAC (Ares Acquisition Corp II) at a ~$2.5 billion pre-money valuation[9]. In 2024, delivered the first autonomous, driverless semi-trucks to a paying customer (Atlas) and secured a 100-truck order[10][11]. U.S. DoD also awarded Kodiak ~$30 million for autonomous military vehicle tech[12]. |

| 6 |

Serve Robotics |

Sidewalk Delivery Robots. Went public (Nasdaq: $SERV) via reverse merger in Aug 2023 and raised ~$40 million in April 2024[13]. Backed by Uber and NVIDIA, Serve has 100+ delivery robots deployed and a contract to scale up to 2,000 robots (for Uber Eats) by end of 2024[14]. Aims for $60–80 million revenue and positive cash flow by end of 2025[15]. |

| 7 |

Collaborative Robotics (Cobot) |

General-Purpose Robots & AI. U.S. startup founded 2022 by ex-Amazon robotics VP. Raised $100 million Series B in April 2024 (led by General Catalyst), valuing it >$500 million[16]. Developing a 5’8″ wheeled robot with AI and LLM-driven interaction[17][18] to work in logistics, retail, healthcare. Funding fuels hiring and production ramp-up[19]. |

| 8 |

Path Robotics |

Automated Welding Systems. Raised $100 million Series D in Oct 2024[20] to advance its AI-driven robotic welders. Based in Ohio, Path’s systems use computer vision to weld without programming, targeting U.S. manufacturing needs. The new funding accelerates deployment in factories amid high demand for automated welding[20]. |

| 9 |

Keenon Robotics |

Service & Hospitality Robots (China). World’s leading commercial service robot maker (23% global market share in 2024[21]). Surpassed 100,000 robots sold (for restaurant delivery, cleaning, etc.)[21]. In 2025, unveiled “XMAN-F1” bipedal humanoid service robots (e.g. bartender and popcorn-serving robots) at WAIC in Shanghai[22], signaling a pragmatic step into humanoids. |

| 10 |

Pudu Robotics |

Service & Delivery Robots (China). Major competitor in hospitality robots (over 100,000 units shipped across 60+ countries[23]). In late 2024, Pudu’s R&D X-Lab introduced “PUDU D9” – a full-size bipedal humanoid robot (170 cm tall, 42 DOF) for logistics and retail tasks[24]. This follows its successful lineup of delivery robots (BellaBot, KettyBot) dominating Asian markets. |

| 11 |

Locus Robotics |

Warehouse AMRs (USA). A leader in autonomous mobile robots for fulfillment centers. In 2024, Locus surpassed 5 billion units picked cumulatively with its robots[25] – a testament to wide adoption by global 3PLs and retailers. Opened a new HQ and continues to win major contracts (e.g. DHL, GEODIS) as warehouses automate order picking at scale[26]. |

| 12 |

Plus One Robotics |

Vision & Parcel Handling (USA). Provides AI vision software for robotic package sorting. Won “Overall Robotics Company of the Year 2024” (SupplyTech Breakthrough Awards)[27]. Launched new turnkey solutions in 2024 (e.g. InductOne dual-arm parcel sorter and DepalOne depalletizer) to automate labor-intensive logistics tasks[28][29]. Notable customers include FedEx and DHL. |

| 13 |

ForwardX Robotics |

Autonomous Mobile Robots – Logistics. China/U.S. maker of vision-guided AMRs for warehouses. In 2024–25, ForwardX expanded globally: opened a new factory to build 5,000 robots/year[30] and forged distribution partnerships in Europe (e.g. Voyatzoglou in EU[31]). Also debuted an autonomous forklift and multi-robot orchestration software (at LogiMAT 2024)[32], broadening its intralogistics offerings. |

| 14 |

Nauticus Robotics |

Underwater Robots & Drones (USA). Transitioned from R&D to commercial operations in 2024 – its “Aquanaut” autonomous subsea robots completed first service jobs in the Gulf of Mexico[33]. Invoiced Phase I of a contract for its next-gen Aquanaut Mark 2 in July 2024[34]. Secured new deals for 2025 and raised additional funds via an at-the-market offering to support scaling its ocean mapping and inspection services. |

| 15 |

Serve Robotics (Coco) |

Last-Mile Delivery Robots (USA). (Coco is a separate startup focusing on food delivery robots.) In mid-2025, Coco partnered with White Castle and Uber Eats to launch autonomous food deliveries in Chicago[35], expanding beyond its Los Angeles base. Coco’s bright pink, remotely supervised robots have been delivering meals in cities, and this new partnership signals growth into national quick-service restaurant delivery. |

| 16 |

Franka Robotics |

Industrial Robotic Arms (Germany). Formerly Franka Emika, known for affordable force-sensitive cobots. Rescued from insolvency via acquisition by Agile Robots in Nov 2023[36]. Renamed “Franka Robotics,” it resumed production – celebrated the 1,000th unit of its FR-3 robot arm in 2024[37]. Now backed by Agile (a Tencent- and ABB-funded unicorn), Franka is scaling its easy-to-use tabletop cobots for global markets. |

| 17 |

UBTECH Robotics |

Humanoids & STEM Robots (China). Continues development of humanoid service robots (e.g. Walker X biped) and AI educational robots. In 2024, UBTECH focused on enterprise and government applications – providing robots for public services and launching new AI educational programs. Though a past consumer humanoid pioneer, UBTECH pivoted toward practical use-cases (like warehouse robots and smart classroom assistants) amid renewed humanoid robotics interest. |

| 18 |

Graze Robotics |

Autonomous Lawn Mowers (USA). In April 2025, Graze announced a partnership with Invited (club management co.) to deploy its autonomous electric mowers on golf courses (e.g. at Gleneagles Club in Texas)[38]. Also expanded to Australia via a deal with BildGroup[39]. Graze’s AI-driven mowers promise fuel savings and 24/7 operations for large-scale turf management – addressing a 50M+ acre landscaping market. |

| 19 |

VEX Robotics & RECF |

STEM Education & Competitions (USA/Global). VEX produces robotics kits and runs competitions via the Robotics Education & Competition Foundation (RECF). In 2024, RECF’s VEX competitions set records with tens of thousands of teams globally, culminating in the VEX Worlds event (recognized by Guinness World Records as the largest robotics competition). VEX also launched new education kits (like VEX GO and EXP) to engage students as young as elementary level in coding and robotics. |

| 20 |

Omron Robotics & Safety |

Industrial & Mobile Robots (Japan/USA). Omron (which acquired Adept) in 2024 released its upgraded LD series autonomous mobile robots with improved LiDAR navigation and AI safety features. Its Robotics and Safety division also introduced new collaborative robot models with enhanced vision and integrated safety compliance for factories. Omron’s mobile robots saw wider adoption in electronics and healthcare logistics, leveraging the company’s global support network. |

| 21 |

Perrone Robotics |

Autonomous Shuttles & Vehicles (USA). Deployed multiple self-driving shuttle programs in 2024. In Detroit, Perrone’s tech powers the “Downtown Connect” autonomous shuttle service (a fleet of Ford E-Transit vans on a 10-mile route)[40]. It also launched Pennsylvania’s first AV shuttle at the Philadelphia Navy Yard in Jan 2024[41]. With its TONY AV retrofit platform, Perrone is enabling low-speed autonomous transit in cities and campuses across the U.S. |

| 22 |

Anyware Robotics |

Truck Unloading AMRs (USA). Emerging startup (founded 2023) developing Pixmo, an AI-powered mobile robot that can autonomously unload boxes from shipping containers and trucks. Raised $12 million seed funding in early 2024[42]. Pixmo combines an AMR base, collaborative arm, and vacuum gripper to handle mixed-size freight – addressing a major pain point in logistics (manual container unloading). Expected to demo commercially at ProMat 2025. |

| 23 |

Anscer Robotics |

Autonomous Mobile Robots (India). Launched the LBR-500 “Low-Bed Robot” in mid-2025 – an omnidirectional AMR designed to automate cart and trolley transport on factory floors[43]. The LBR-500’s low-profile lift and 500 kg capacity let it replace bulky tuggers and forklifts for in-plant material movement[44]. Anscer (founded 2019) also rolled out the AR-1000 tugger AMR, aiming to modernize intralogistics in Indian and North American factories[45]. |

| 24 |

Eureka Robotics |

Precision Automation (Singapore). Raised $10.5 million Series A in Dec 2024[46] to expand internationally. Known for its AI-powered robots capable of fine precision (the company’s robot famously assembled an IKEA chair). Eureka’s Robotics Toolkit (software) and “Archimedes” robot arm are used for high-precision tasks (optics handling, electronics testing). The new funding (led by Lenovo and UTEC) is helping Eureka scale its deployments in the U.S. and Japan[46]. |

| 25 |

Chef Robotics |

Food Service Automation (USA). Developing AI-driven robotics for commercial kitchens and meal assembly. In March 2025, Chef Robotics raised $43 million in Series A funding (equity + debt)[47] led by Avataar Ventures, bringing total funding to ~$60 million. The company’s systems aim to automate tedious food prep tasks (like bowl assembly, ingredient dispensing) for quick-serve restaurants, addressing labor shortages and consistency in food service. |

| 26 |

Corvus Robotics |

Warehouse Inventory Drones (USA). Maker of autonomous indoor drones that perform automated inventory scans in warehouses. Raised $18 million Series A in Oct 2024[48] to accelerate deployments. Its Corvus One drone can fly indoor warehouse aisles to scan pallet barcodes and update inventory systems autonomously[49], reducing the need for manual cycle-counts. Several 3PLs and retailers began pilot programs with Corvus drones in 2024. |

| 27 |

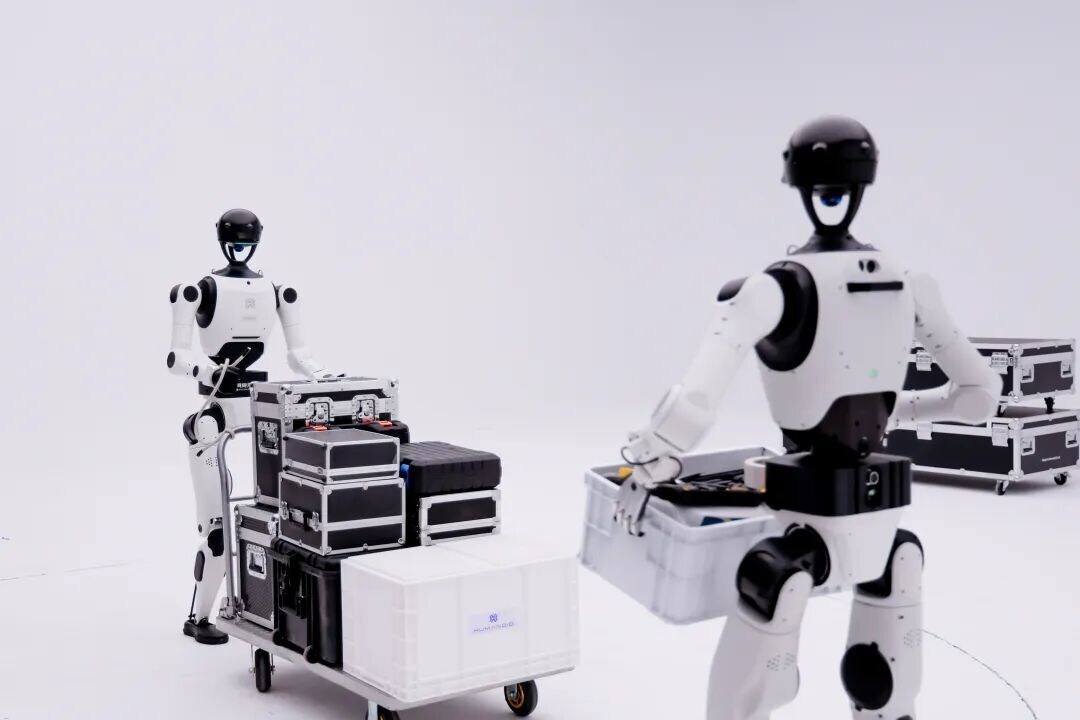

EngineAI Robotics |

Humanoid Robots (China). Shenzhen-based startup (also called ZhongQing Robotics) focused on full-size humanoids. In Oct 2024 it launched “SE-01”, a 1.75 m tall humanoid robot with 41 degrees of freedom[50], as well as a smaller PM-01 model[51]. EngineAI’s humanoid can walk ~1 m/s and converse in multiple languages, and it has been demonstrated in marathons and expos. It emphasizes open-platform development – positioning as a Chinese answer to Tesla’s Optimus. |

| 28 |

AiMOGA Robotics |

Humanoids & Retail AI (China). Robotics arm of auto-maker Chery. Debuted “MORNING (Mornine) Humanoid” in 2024 – a humanlike robot deployed as a car showroom sales assistant[52]. The AIMOGA robot can walk, recognize speech (via DeepSeek AI), respond in 10 languages, and perform gestures to explain car features[53]. Chery has begun using these blonde humanoid robots in flagship 4S dealerships (in Malaysia and China), a world-first in automotive retail. |

| 29 |

Huayan Robotics |

Collaborative Robots (China). Formerly Han’s Robot (spun out of Han’s Laser). Rebranded to “Guangdong Huayan Robotics” in 2023[54] as it expands globally. A leading Chinese cobot manufacturer with a broad lineup (payloads 3–20 kg), Huayan confidentially filed for a Hong Kong IPO in 2024 aiming to raise over $200 million[55]. It also introduced specialized cobots like an explosion-proof model for automotive painting[56]. Offices have expanded to EU and Asia as Huayan (Han’s) seeks international market share. |

| 30 |

Guozi Robotics |

Industrial Automation (China). Turnkey factory automation provider. In July 2025, Guozi deployed 200+ robots at TZ Group’s new “lights-out” smart factory[57], showcasing its “full-spectrum” automation capabilities (from robotic welding and assembly to automated guided vehicles). Guozi (based in Zhejiang) integrates robots, vision systems, and software to automate manufacturing lines. It’s part of China’s push for smart factories, often cooperating with local government initiatives. |

| 31 |

Sniffer Robotics |

Environmental Drones (USA). Specializes in drone-based methane leak detection at landfills and industrial sites. Its patented SnifferDRONE (with a tethered sensor) received EPA approval (OTM-51) for surface emissions monitoring[58][59]. In April 2025, Sniffer partnered with Project Canary to provide real-time quantified methane measurements at landfills[60][58] – enabling operators to quickly pinpoint and fix leaks (“sniffing for dollars” by recovering wasted gas). Sniffer’s tech vastly speeds up compliance surveys versus manual methods. |

| 32 |

Bedrock Robotics |

Subsea Mapping (USA). (Bedrock Ocean Exploration) Develops autonomous underwater drones (AUVs) to map the seafloor. In June 2025 it secured $25 million in Series A2 funding led by Primary Ventures[61]. Bedrock’s 4.5 m AUV “AquaRay” can survey for 12 hours and transmits high-resolution sonar data via cloud, promising to replace expensive survey ships[62][63]. The startup achieved a milestone in 2024 by completing pilot surveys and launching a public seafloor data platform, all as part of its mission to map the ~70% of Earth (the oceans) that remains mostly unmapped. |

| 33 |

Entropy Robotics |

Autonomy Software (USA). An AI startup developing edge AI navigation software for drones and robots in GPS-denied or complex environments. Announced a strategic R&D collaboration with SRI International in early 2025 to advance autonomous navigation in challenging settings[64]. Entropy’s plug-and-play “AI Flight Stack” enables commercial drones to perform inspection and mapping missions with minimal human input. The company’s tech has potential applications from industrial inspections to defense, where robust autonomy is required. |

| 34 |

Platform Robotics |

Agricultural Automation (USA). A niche robotics firm in Michigan focusing on cannabis cultivation automation. Debuted the “Softrim” bladeless robotic de-leafer at MJBizCon 2024[65] – an automated system that gently removes excess leaves from cannabis plants to improve yield and save labor. Platform Robotics’ system mounts on existing grow racks and trims with precision, preventing crop damage. With cannabis greenhouse labor costly, this tech drew interest from cultivators aiming to scale operations efficiently. |

| 35 |

OrionStar Robotics |

Service Robots (China). Developer of humanoid service and delivery robots (spun off by Cheetah Mobile). In Sept 2024, OrionStar launched “CarryBot,” a logistics robot for micro-fulfillment centers[66], extending its lineup beyond restaurant and hospitality bots. CarryBot can autonomously navigate tight back-of-store spaces to ferry goods. OrionStar’s earlier products (like the LuckiBot reception robot) continued to gain traction in hotels, malls, and hospitals across Asia, and it positioned CarryBot to capitalize on the rising demand for automated fulfillment in retail. |

| 36 |

Restore Robotics |

Medical Device Servicing (USA). A unique player that refurbishes and services surgical robots (like the da Vinci) and their instruments. In 2024, Restore was embroiled in an antitrust legal battle with Intuitive Surgical (maker of da Vinci) over the right to service end-of-life surgical tools[67]. While Intuitive ultimately prevailed in court (protecting its service monopoly)[68], Restore’s fight highlighted hospitals’ desire for more cost-effective third-party maintenance. The company continues to offer alternatives for extending the life of expensive robotic surgery equipment. |

| 37 |

Vantage Robotics |

Small Drones & Defense (USA). Known for its safe UAVs (e.g. Snap drone) and as an FAA-approved drone supplier. In Sept 2024, Vantage launched “Trace,” a pocket-sized nano drone for covert reconnaissance[69] aimed at military and police use. It also landed a U.S. Army development contract for the next-gen platoon reconnaissance drone[70]. In Feb 2025, Indian drone maker ideaForge made a strategic investment/partnership in Vantage to integrate their nano-drone tech into ideaForge’s global offerings[71][72]. This partnership gives Vantage scale, while ideaForge fills a product gap in nano-drones. |

| 38 |

Peer Robotics |

Mobile Cobots (USA/India). Startup offering a novel “follow-me” mobile robot that learns workflows by example. Its compact AMRs can be guided by a worker once and then repeat the material transport task autonomously. In 2024, Peer Robotics pilots expanded in manufacturing SMBs – the robots are used to move parts between workstations without complex integration. The company also joined an accelerator program in North America and secured seed investment (undisclosed) to refine its human-friendly interface, aiming to help factories automate without robot programming expertise. |

| 39 |

Symphony Robotics |

Robotics Integrator (USA). A newcomer that made waves in early 2025 by unveiling an AI-driven robotics orchestration platform named “Symphony”. Targeting advanced manufacturing, it “conducts” multiple robot arms and AGVs in unison on a factory floor – hence the name. Although not much public data yet, Symphony Robotics has drawn attention for being founded by former Amazon and Fanuc engineers. In 2025 it announced a pilot project with an automotive OEM to automate final assembly tasks using its coordinated multi-robot system, hinting at future growth. |

| 40 |

Daimon Robotics |

Tactile Sensors & Manipulation (China). Shenzhen-based startup focusing on robotic touch and dexterous manipulation. In 2024 it secured over RMB 100 million (~$15 million) in “Angel++” funding[73] to develop high-resolution, high-frequency tactile sensor arrays for robot hands. In April 2024, Daimon officially launched a line of robotic grippers with integrated vision-tactile sensing[74] – touted as the world’s first of their kind. These sensors allow robotic fingers to adjust force dynamically, enabling delicate operations (useful in electronics assembly, for example). Daimon’s tech aims to give robots a human-like sense of touch for more precise and gentle manipulation. |

| 41 |

SoftBank Robotics |

Service Robots & AI (Japan). SoftBank’s robotics unit (makers of Pepper and Whiz robots) pivoted in 2024 towards enterprise solutions. SoftBank Robotics America focused on commercial deployments of Whiz, an AI-powered autonomous vacuum, scaling it in office and airport cleaning contracts. The division also introduced AI customer service kiosks (Pepper avatars on screens) in Japan’s retail stores as SoftBank moved away from humanoid hype to practical AI assistance. While global headcount was downsized in prior years, in 2024 SoftBank formed new partnerships – e.g. with Neo for co-branded floor scrubbers – leveraging its brand to remain a player in service robotics. |

| 42 |

4AG Robotics |

Agricultural Robots (Canada). Developing autonomous mushroom harvesting robots. Closed a C$40 million Series B (~$29 million) in 2024[75] to scale production of its vision-guided picker. The 4AG robot travels along mushroom farm racks, using cameras and AI to identify mature mushrooms and a gentle gripper to pick them. This addresses a labor-intensive farm task. By 2025, 4AG moved from pilot trials to initial commercial units in Canadian mushroom farms and planned U.S. and Netherlands launches using the new capital[75]. |

| 43 |

Human in Motion |

Wearable Exoskeletons (Canada). Creator of XoMotion, a lower-body exoskeleton that helps wheelchair users walk. Achieved a key milestone in Sept 2024: Health Canada regulatory approval to market XoMotion as a medical device[76] (a first in Canada for a self-balancing exoskeleton). XoMotion’s advanced design (with powered hip-knee-ankle joints and dynamic self-balancing) allows hands-free operation and more natural gait patterns[77]. Human in Motion is now conducting rehab clinic trials and preparing for broader commercialization, offering new mobility hope for those with spinal cord injuries. |

| 44 |

Artimus Robotics |

Artificial Muscles (USA). Pioneering HASEL electrohydraulic actuators for soft robotics. In 2024, Artimus won a £1.5 million UK ARIA grant to develop lifelike artificial muscles for robotics[78]. It also launched a new multi-channel high-voltage driver product, making it easier for engineers to integrate HASEL actuators[79]. These paper-thin actuators enable quiet, flexible motion – Artimus sees applications in medical devices, industrial grippers, and even aerospace. With ~$3.5 million US government funding secured for R&D[80], Artimus is pushing the frontier of soft robotics and compliant actuators. |

| 45 |

Mecademic Robotics |

Miniature Industrial Arms (Canada). Manufacturer of some of the world’s smallest precision robot arms (Meca500 series). In 2024, Mecademic upgraded its flagship 6-axis arm with an improved controller and introduced an optional vision module, enhancing its appeal for desktop automation tasks. The company saw growing adoption in electronics testing, watchmaking, and academic research – any domain requiring ultra-compact yet precise robots. Mecademic also expanded its global distributor network across Asia and Europe in 2024, fueling export growth of these pint-sized Canadian robots. |

| 46 |

Cellula Robotics |

Unmanned Underwater Vehicles (Canada). Specializes in autonomous subsea systems. In 2024, Cellula’s Solus-XR extra-long-range AUV (powered by hydrogen fuel cell) completed endurance tests, demonstrating multi-day undersea missions for pipeline inspection. The firm also secured a contract with a Southeast Asian navy to supply its SeaWolf unmanned underwater sensor platforms for port security. As offshore wind and marine minerals gain focus, Cellula’s expertise in AUVs and seafloor drills (it has a prototype robotic seabed mining system) positions it well in the growing blue economy robotics market. |

| 47 |

Entropy Robotics (Team) |

Combat Robotics (USA). Not to be confused with the autonomy startup above, “Team Entropy” is also the name of a combat robotics team (battlebots) founded in 2022. They compete in the Midwest Robot Combat Association events with their heavyweight robot “Entropy.” In 2024, Team Entropy’s robot – featuring a destructive spinning weapon – placed in the quarter-finals of a national battlebots competition, showcasing innovative engineering in high-impact robotic sports. (This entry highlights the breadth of “Entropy Robotics” namesakes – from AI drones to fighting robots.) |

| 48 |

Mind With Heart Robotics |

Therapeutic & Educational Robots (USA). A small non-profit initiative exploring robotics for mental health therapy and special education. In 2024, they prototyped “BuddyBot”, a soft interactive robot companion designed for children with autism – it can mirror emotions with simple facial expressions and guide users through breathing exercises. Mind With Heart also ran pilot workshops in California schools with robot-assisted mindfulness sessions. While very early-stage, it reflects a growing trend of leveraging robots for social and emotional support roles. |

| 49 |

Sunseeker Robotics |

Solar-Powered Robotics (USA). A startup working on robots that can operate indefinitely on solar power. In 2024 it unveiled a prototype of a solar-powered UAV that can continuously loiter in the stratosphere for days – effectively a pseudo-satellite for communications or surveillance. Sunseeker also tested a small solar-powered rover for agricultural monitoring that recharges itself in the field. Although R&D is ongoing and it’s pre-revenue, Sunseeker’s vision of perpetual-operating robots taps into the need for sustainable, long-endurance autonomous systems. |

| 50 |

Zero Zero Robotics |

Consumer Drones (China). Known for the “Hover Camera Passport” selfie drone, Zero Zero pivoted to action cameras. In Aug 2024 it launched the HoverAir X1 Pro – a pocket drone that doubles as a flying 4K camera – via an Indiegogo campaign[81]. The company highlighted advanced features like motion tracking and a guaranteed-delivery crowdfund, signaling confidence in manufacturing. Zero Zero also showcased its tech at global expos, but with increasing competition in personal drones (DJI etc.), it remains to be seen if HoverAir can finally take off in the consumer market[82]. |