The Commercialisation of Robotics: 2025 as the Tipping Point Year

29 December 2025 | Market Trend

Falling robot costs, mature AI and urgent labour and sustainability pressures have pushed robotics from pilots to scaled deployments, making 2025 the year leaders tied automation directly to margins, contracts and operational resilience.

Robotics Reaches an Inflection Point

Robotic automation is no longer a futuristic concept reserved for factory prototypes or tech expos – in 2025 it has become a boardroom priority and a cornerstone of competitive strategy. After years of steady technological progress and pilot programs, 2025 stands out as a tipping point when robotics crosses from experimentation into broad commercial adoption. Several converging factors are driving this transformation: mature AI and sensor technologies, dropping hardware costs, supportive policies, and urgent business needs like labour shortages and sustainability mandates. The global market value of industrial robot installations hit an all-time high of $16.5 billion recently, and venture capital is pouring into robotics startups at record levels. Crucially, success stories from logistics warehouses to hospital wards are demonstrating real ROI and productivity gains, persuading even cautious executives that the economics of robotics now make compelling sense. In short, robotics has moved from the lab to the core of business strategy, with 2025 marking the year this shift became undeniable.

This executive overview examines how robotics is driving margin expansion, the key commercial contracts and industry trends accelerating deployment, major investments and corporate milestones, and why factors like ESG goals, workforce dynamics, and geopolitics have aligned to make 2025 the year of robotics commercialisation. The tone is forward-looking and practical – focused on what investors and business leaders need to know as they navigate this automation revolution.

Margin Expansion Through Automation and ROI Gains

One of the most compelling arguments for robotics in 2025 is its impact on profit margins. Automation directly drives cost efficiencies and output gains that expand the bottom line. Labour is often the largest operating expense in sectors like manufacturing and warehousing. By deploying robots for repetitive, low-value tasks, companies can reduce labour cost per unit while redeploying human workers to higher-value roles. For example, in warehouses robots now handle routine transporting and picking, cutting the number of staff needed and overtime hours, and shrinking order cycle times. Improved throughput and accuracy mean businesses can process more orders with fewer errors – reducing rework, returns and waste. A case study in one distribution centre showed that upgrading to a robotic picking system boosted picking efficiency by 70% and saved $445,000 annually in labour costs. Another benefit was a 50% reduction in mis-picked orders, saving $250,000 per year and improving customer satisfaction. These tangible efficiency gains all flow through to improved profit margins.

Crucially, the return on investment (ROI) for robotics has become very attractive. Many deployments now pay for themselves within a year or two. Industry analysts note that “a strong automation ROI typically delivers payback in 12–24 months”, with best-in-class projects even recouping costs in under 12 months. After this quick breakeven, the ongoing labour savings, higher output and lower defect rates directly expand operating margins. Beyond the “hard” ROI of cost reduction, there are “soft” benefits that sustain margins long-term: lower employee turnover (because robots relieve the most monotonous work), higher safety (reducing costly injuries), and improved customer retention due to better quality and faster delivery. All these factors contribute to a more productive and resilient operation, which is ultimately reflected in healthier margins.

Executives are also finding that robotics can unlock new revenue opportunities alongside cost savings. Automation improves consistency and throughput, enabling companies to take on more orders or enter new markets without proportionally increasing headcount. With robots, factories can run longer hours (even lights-out overnight shifts) to boost output. In warehouses, automation allows e-commerce players to meet surging order volumes without sacrificing delivery speed or accuracy – protecting revenue that might otherwise be lost to bottlenecks. In short, 2025’s robotics solutions are directly linked to profitability: they reduce operating costs, increase capacity, and improve quality. For investors focused on margin expansion, the companies that successfully leverage robotics are likely to enjoy a competitive cost structure and the ability to scale business efficiently.

Sector Spotlights: Robotics Transforming Key Industries

Robotics is making especially deep inroads in logistics, healthcare, and manufacturing – sectors at the heart of the global economy. Each of these industries faces unique pressures that robotic automation is well-suited to address, and 2025 has seen an acceleration of strategic deployments in all three.

Logistics and Supply Chain Automation

If any sector encapsulates the commercial robotics boom in 2025, it is logistics. Warehouses, distribution centres and fulfilment operations have become hotbeds of automation as companies race to handle growing e-commerce volumes, consumer demands for speed, and chronic labour shortages in manual warehouse jobs. Retail and logistics giants are signing major contracts with robotics providers to automate everything from inventory storage to picking, packing and truck loading. One landmark deal this year saw Walmart deepen its partnership with warehouse automation firm Symbotic – not only rolling out Symbotic’s robotic systems across hundreds of distribution centres, but also selling Walmart’s own in-house robotics division to Symbotic to consolidate innovation. Under the new 2025 agreement, Walmart will invest $520 million in Symbotic’s technology and gave an initial order covering hundreds of stores. This 12-year exclusive deal essentially cements Symbotic as the backbone of Walmart’s automated supply chain. Investors rewarded the move, sending Symbotic’s stock up 14% on announcement – a clear sign that public markets see automation contracts with blue-chip customers as transformational.

Warehouse robotics deployments are becoming ubiquitous, from automated guided vehicles shuttling pallets to AI-powered robotic arms that can pick individual items. Amazon famously spearheaded warehouse automation after acquiring Kiva Systems, and it continues to innovate – in 2023 Amazon unveiled “Proteus,” a mobile warehouse robot that navigates freely among human workers. By 2025 Amazon is also testing bipedal humanoid robots (such as Agility Robotics’ Digit) in its facilities, aiming to have robots assist with the unglamorous task of lifting and moving totes. Other retailers and 3PL logistics providers are following suit. For example, grocery chain Walmart is not only automating regional distribution centres, but also exploring autonomous forklifts and truck-loading robots as it looks to streamline operation. DHL and FedEx have likewise invested in robotic parcel sorters and tuggers for hubs. These moves are driven by clear payoffs: automated warehouses can operate 24/7 with higher throughput and lower error rates, and they are less vulnerable to labour market fluctuations. A recent analysis noted that warehouse automation projects often achieve full payback within 1–2 years, thanks to big gains in labour efficiency and order accuracy. Once in place, these systems cut variable costs per order and protect profit margins even during demand surges.

Beyond the warehouse, robotics is also transforming last-mile and supply chain logistics. In 2025, several cities are piloting sidewalk delivery robots and autonomous delivery vehicles, which could reduce the cost of e-commerce delivery over time. Logistics is inherently a low-margin business, so the prospect of automation-driven margin expansion is highly attractive. The momentum seen in 2025 – major procurement deals, new robotics-as-a-service offerings for warehouses, and advancements in AI vision that let robots handle previously un-automatable tasks – suggests logistics may be hitting a tipping point. Warehousing and freight firms that don’t adopt these technologies risk higher costs and slower cycles than competitors that do. Little wonder that investors are closely watching robotics-focused players in this space (e.g. Ocado’s warehouse automation tech, or startups like Berkshire Grey and Brightpick), anticipating that logistics automation leaders will capture outsized market share and profit in coming years.

Healthcare and Medical Robotics

In hospitals, collaborative robots (like ABB’s dual-arm YuMi, pictured above handling test tubes) are assisting medical staff with precise, repetitive tasks, exemplifying how automation can improve efficiency and quality in healthcare.

Healthcare presents a very different set of challenges – an ageing population, demand for higher precision, and a need for better productivity in the face of clinician shortages. Here too, 2025 marks a period where robotics moves from specialised niches to mainstream adoption. Surgical robots are a prime example. Intuitive Surgical’s da Vinci system has been in operating theatres for two decades, but now a growing array of competitors and new surgical robotics platforms are entering the market, often at lower price points or tailored for specific procedures. This increased competition is driving adoption beyond elite hospitals. By 2025, robot-assisted surgery is used in a widening range of specialties (urology, orthopaedics, cardiology, etc.), and major medtech firms like Medtronic and J&J have launched their own surgical robot offerings. The globalmedical robotics market is on a rapid growth trajectory – forecast to grow from about $13 billion in 2025 to over $39 billion by 2034. This reflects not only surgical systems but also robotic rehabilitation devices, telepresence robots for remote care, and pharmacy automation.

Hospitals are also investing in robots for logistical and support tasks. Autonomous mobile robots zip through corridors delivering medicines and samples, reducing the burden on nursing staff. In laboratories, robotic arms (such as the ABB YuMi shown above at Karolinska Hospital) handle repetitive tasks like test tube processing with greater speed and accuracy than human lab techs. This not only improves throughput but ensures consistent quality – a key consideration in healthcare outcomes. Post-pandemic, UV disinfecting robots have been deployed in many hospitals to regularly sanitize rooms, reflecting how infection control protocols now include automation. And in elder care and physical therapy, assistive robots and exoskeletons are starting to augment human carers, helping patients with mobility and exercise. While still early, these use cases speak to a future where robots help scale healthcare services safely and cost-effectively.

For healthcare executives, ESG and patient safety goals are also drivers of automation. Robots can take over “dull, dirty and dangerous” tasks (a common theme across industries), from cleaning floors to prepping IV bags, thereby reducing workplace injuries and freeing up skilled staff for direct patient care. Notably, leading hospitals emphasize that robots augment their healthcare workforce rather than replace it – the goal is to improve care quality and operational efficiency simultaneously. The social benefits resonate with ESG objectives: robotics can lower clinician fatigue, decrease manual handling injuries, and enhance patient outcomes via precision. As healthcare budgets face pressure, the ability of robotics to improve productivity per clinician is highly valuable. The year 2025 is seeing more healthcare providers treat automation as a strategic imperative, not a novelty, indicating a commercial tipping point similar to what manufacturing experienced decades ago. Investors are watching medtech robotics companies (from surgical platforms like CMR Surgical which raised $200 million, to startups in hospital logistics) for signs of breakout growth as the healthcare sector catches up in automation.

Manufacturing and Industrial Automation

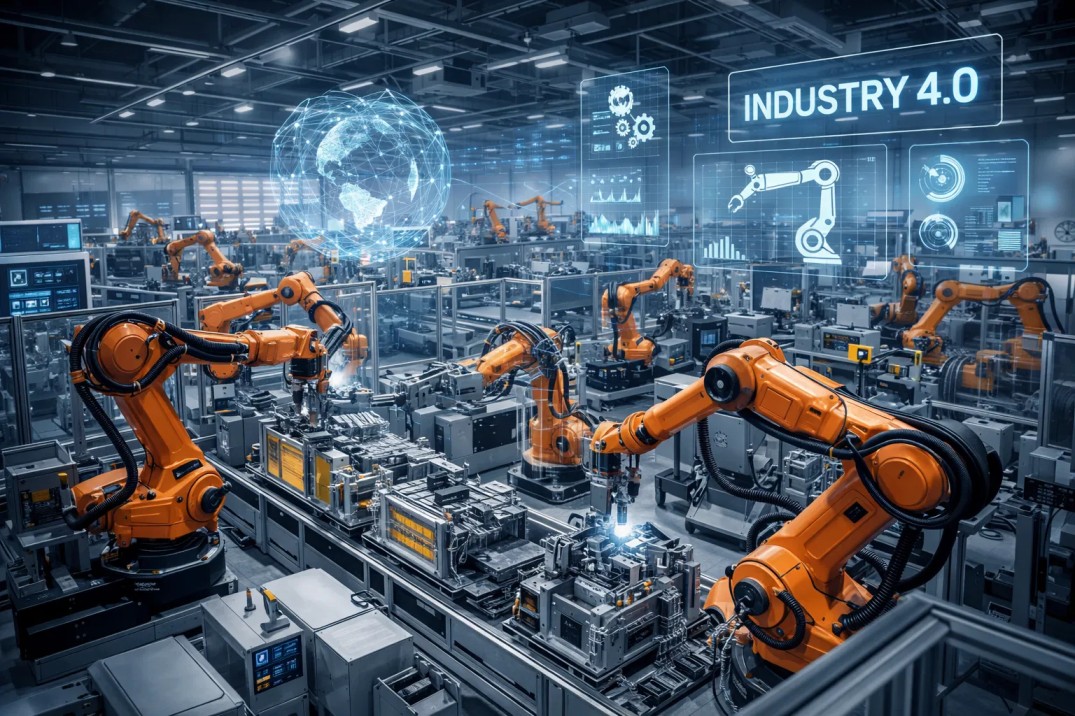

Manufacturing was the original domain of industrial robots, and it remains at the forefront of robotics commercialisation. What’s new in 2025 is the breadth of adoption. Traditionally, automotive plants and semiconductor fabs were heavy robot users, but now small and medium-sized manufacturers and diverse sectors are deploying robots to boost productivity and offset labour gaps. The latest data show factories worldwide installed over 542,000 industrial robots in 2024 – more than double the annual installations of a decade ago. This brings the operational stock of industrial robots to around 4.66 million units globally, a record high. Asia leads the charge: China alone accounted for 54% of new robot installations in 2024, adding roughly 295,000 units and surpassing 2 million robots in operation. Other manufacturing powerhouses like Japan, South Korea, the US and Germany also continue to invest steadily in automation. The expansion in China is especially notable – driven by rising labour costs and government policy, Chinese firms are installing robots at an unprecedented pace to stay competitive and meet output demand in electronics, machinery and consumer goods manufacturing.

Crucially, robots are breaking out of the automotive assembly line and finding uses in many industries. In 2024, the electronics industry actually surpassed automotive in annual robot installations, accounting for ~128,900 units (vs ~122,000 in autos). Sectors like metals, plastics, food and pharmaceuticals are all seeing double-digit growth in robot uptake. The rise of collaborative robots (cobots) has been a game changer for smaller manufacturers. Unlike traditional industrial robots that require safety cages and expert programming, cobots are user-friendly, flexible robotic arms that can work side-by-side with humans on assembly, machine tending or quality inspection. This lowers the barriers for factories that couldn’t accommodate or justify classic automation. The International Federation of Robotics projects cobot adoption to grow at ~30% annually around 2025, particularly in industries like electronics, automotive components, and pharma where high mix, small batch production is common. Leading cobot maker Universal Robots reported 35% sales growth in 2024, indicating strong demand as companies seek to automate secondary processes and support human workers on the line.

For manufacturers, the case for robotics blends productivity and quality gains with the realities of an ageing skilled workforce. Robots can perform welding, painting, assembly and inspection tasks with tireless consistency, improving yields and reducing defects. At the same time, they help solve skills gaps – for example, welding robots address the shortage of experienced welders. The labour shortage factor cannot be overstated: many industrialised countries face demographic decline in their manufacturing workforce. The IFR notes that “the global manufacturing sector continues to suffer from labor shortages” due to demographic change, and companies are turning to robots to fill the gap. By automating the “dirty, dull, dangerous or delicate” tasks, manufacturers can reallocate human workers to higher-value jobs in programming, maintenance or quality engineering. This narrative – that robots augment the workforce rather than replace it – has become the dominant message in 2025. Even labour unions in some regions have come to cautiously support automation when it is used to take over unsafe tasks and when companies invest in retraining employees. The Shifts in labour dynamics are further discussed below, but in manufacturing the trend is clear: companies that embrace robotics are seeing gains in efficiency and resilience, and those gains are now vital for staying competitive amid global cost pressures.

Manufacturing executives also recognise robotics as key to supply chain resilience and localisation strategies. Recent crises (trade wars, pandemics, geopolitical tensions) have pushed firms to nearshore or reshore production. However, bringing manufacturing back to high-wage economies is only feasible with high automation to maintain cost efficiency. Automation is thus enabling new “Factories of the Future” that can operate competitively in domestic markets. Governments are encouraging this; for instance, policies in the US, EU, Japan, and China all include incentives for advanced manufacturing deployment. As a result, 2025 is seeing robotics underpin a wave of investment in domestic production capacity in areas like semiconductors, EV batteries, and critical infrastructure. In short, manufacturing is experiencing both a broadening and deepening of robotics adoption – broadening to more sectors and company sizes, and deepening in advanced facilities aiming for world-class efficiency. For investors and business leaders, the implication is that automation is now a baseline requirement for industrial competitiveness, not an optional innovation. Companies hitting milestones – e.g. ABB delivering its 500,000th robot, or startups like Agility Robotics opening the world’s first factory capable of mass-producing humanoid robots (with a planned output of 10,000 units per year) – illustrate how far the industry has come in scaling up robotics commercially

Sustainability and ESG: Automation with a Green Purpose

Robotics is not just about profit – it is also emerging as a tool to meet environmental, social, and governance (ESG) objectives. In 2025, many corporations are finding that automation projects can advance their sustainability agendas and help satisfy stakeholders concerned with ethical operations. On the environmental side, robots can significantly improve resource efficiency. Their precision and consistency mean less material waste and scrap, as processes like painting or cutting are done optimally every time. In manufacturing, this boosts the output-to-input ratio, yielding more product per unit of material or energy used. High repeatability also ensures quality products that last longer and need fewer replacements or repairs, aligning with sustainability goals of longevity and reduced consumption. Additionally, robots are essential for scaling up green technologies: for example, producing solar panels, wind turbines, or batteries for electric vehicles in the volumes needed for a clean energy transition would be infeasible without automation. The International Federation of Robotics explicitly notes that “in the production of green energy technologies such as solar panels, batteries for electric cars or recycling equipment, robots are critical to cost-effective production”, allowing manufacturers to meet growing demand without compromising quality or sustainability.

Robotics firms themselves are innovating to make robots more energy-efficient, which improves the “Scope 2”footprint of automation. Advances include lightweight robot arm designs (reducing the power needed for motion) and smart power modes that put robots into low-energy states when idle. New gripper technologies inspired by biology can achieve strong grip with almost no continuous power draw. ABB, for example, introduced energy-saving industrial robots that cut power usage by 20–30% compared to previous models. For companies deploying thousands of robots, these efficiency gains translate to substantial electricity savings and lower carbon emissions over time. A sustainable automation strategy thus looks not only at what tasks are automated, but also at how – choosing energy-efficient models, redeploying robots to minimise idle time, and integrating renewable energy where possible to power automated facilities.

On the social and governance side of ESG, robotics can improve workplace safety and job satisfaction, reinforcing a company’s social license to operate. Robots excel at tasks that are hazardous or ergonomically punishing for humans. By reducing workers’ exposure to dangerous environments (like toxic fumes, extreme temperatures, heavy lifting), automation helps cut injury rates and occupational health risks. For instance, mining companies are deploying robots to handle explosives or autonomous haulage trucks, aiming for the bold goal of “zero harm” in operations. In manufacturing, heavy or repetitive lifting is a common source of injuries – leading firms like TSMC have introduced collaborative robots to handle repetitive loading of semiconductor wafers, significantly reducing repetitive strain injuries among their staff. These improvements in worker safety and health align with the “S” in ESG, demonstrating a commitment to employee welfare. In turn, safer workplaces tend to have higher morale and lower turnover, which has financial benefits (less lost time, lower training costs) that feed back into productivity.

Another social aspect is how robotics can enhance job quality. When robots take over the most tedious tasks, human workers can be upskilled to supervise robots, perform maintenance, or focus on creative problem-solving. This can lead to more engaging work and the development of a higher-skilled workforce over time. Surveys show employees are often open to retraining for managing or programming robots – one poll found 70% of workers would participate in such training. Companies embracing robotics in 2025 often highlight their reskilling programs and how automation is empowering their employees rather than displacing them. This narrative is important for governance and reputation: it shows that management is proactive about technological change and cares for its people. In some cases, adopting automation can even fulfill specific governance mandates – for example, in highly regulated industries, robots provide traceability and compliance (every robotic action can be logged and audited), helping meet governance standards for quality and transparency.

Finally, compliance and procurement are being linked to sustainability, which indirectly pushes robotics forward. Large OEMs and retailers are increasingly asking suppliers about their environmental and safety practices. Being able to demonstrate that your factory uses cutting-edge automation to minimise waste and ensure worker safety can become a selling point or a requirement to win contracts. As the IFR observed, “compliance with the UN’s environmental sustainability goals and corresponding regulations is becoming an important requirement for inclusion on supplier whitelists. Robots play a key role in helping manufacturers achieve these goals.” In this way, ESG mandates can act as a catalyst: companies adopt robots not only for efficiency but to meet the expectations of investors, customers, and regulators regarding sustainable and responsible operations. The year 2025 finds robotics and sustainability in a mutually reinforcing relationship – greener, safer operations are possible through automation, and the pursuit of ESG targets accelerates the business case for investing in the latest robotics.

Investment, Emerging Players, and Corporate Strategies

The financial landscape around robotics in 2025 is one of surging investment and strategic realignment, as both startups and established firms position themselves for the coming boom in automation. After a dip in 2022–2023, venture capital and private equity interest in robotics has rebounded strongly, driven by advances in AI and a recognition that robotics is poised to revolutionise multiple trillion-dollar industries. In the first half of 2025 alone, over $6 billion of venture funding flowed into robotics startups worldwide. By Q2 2025, quarterly investment in robotics deals neared $8.8 billion – a triple-digit increase over prior quarters and on track to eclipse the total for 2024. This represents a rare surge outside the core hype category of generative AI, indicating that robotics has come into its own as a focus area for “smart money.” Notably, the investor base is broadening: traditional Silicon Valley VC giants (Sequoia, a16z, Lightspeed, etc.) are active in robotics deals, and so are corporate venture arms of tech and industrial firms (Nvidia, Google, Amazon, Siemens). Even late-stage capital and private equity funds are moving in, aiming to back the winners of this transformative wave.

A look at the largest funding rounds of 2025 reveals the breadth of opportunities investors see in robotics. According to Crunchbase data, top deals included: Neuralink raising $650 million (brain-computer interfaces with robotic implantation systems), Apptronik raising $403 million (humanoid robots for industrial work), CMR Surgical raising $200 million (next-gen surgical robots), and several others in the $100M+ range spanning fields from household service robots to industrial AI software Humanoid robotics has captured particular imagination – Apptronik’s $350M round led by Google and others is aimed at scaling production of its Apollo humanoid for warehouse tasks. Likewise, Germany’s Neura Robotics secured over $120M to develop “cognitive” humanoid assistants. These massive bets reflect a belief that general-purpose robots which can work alongside humans could address huge labour pools across logistics, manufacturing and beyond. While some skepticism remains about how soon humanoids will be truly cost-effective, these investments suggest many think the inflection is near. As one industry commentator put it, humanoid robotics – “once a speculative dream” – is now “inching closer to commercial reality” in the eyes of investors.

Importantly, sector-focused robotics startups are also attracting capital, not just flashy humanoids. Investors are keen on targeted automation solutions for specific high-value problems. For example, food processing has seen startups like Chef Robotics raising funds to automate food prep and address labour shortages in that industry. Niche areas like maritime shipping have startups (e.g. autonomous hull-cleaning robots) securing investment to reduce fuel waste and costs for ship operators. The theme is that solving painful, costly problems with robotics – whether it’s unloading trucks, inspecting infrastructure, or automating lab work – is a viable path to scale. This aligns with investors’ preference for clear use-cases and nearer-term revenue, given that some general robotics plays can be very long-horizon. In 2025, we see investor discipline in backing startups that either have a credible path to monetisation or strategic partnerships to speed deployment. The abundance of capital is tempered by an understanding that robotics hardware can be capital-intensive and slower to market than pure software. Thus, many VCs favour startups that combine hardware with AI/software differentiation, or those that offer Robotics-as-a-Service models to generate recurring revenue.

On the public company side, the story is one of both opportunity and consolidation. A few years ago, there were only a handful of publicly traded pure-play robotics companies (apart from large industrial conglomerates). By 2025, that roster has grown via IPOs and SPAC mergers – examples include Symbotic (NASDAQ: SYM) which went public in 2022 and now boasts a ~$20B+ market cap on the strength of its retail warehouse automation contracts, and Vicarious Surgical (NYSE: RBOT) in surgical robotics. However, the overall number of big exits is still limited; industry observers note a “relative scarcity of successful M&A exits or public offerings for robotics companies” to date. This has made some investors cautious, but it also implies a large pipeline of mature private companies that could IPO or be acquired in coming years as the market matures. Many emerging leaders are still private – for instance, Agility Robotics (humanoid warehouse robots) reached a $2.1B valuation after a $400M Series C in 2025, Gecko Robotics (industrial inspections) is valued over $1B on the back of contracts with the US Navy and oil companies, and Figure AI (humanoid robots) achieved a jaw-dropping ~$34B valuation in late 2025 amid speculation about its technology and backing by big names. These companies are potential IPO candidates or acquisition targets, and investors are tracking their progress closely.

Established tech and industrial corporations are also manoeuvring to secure their place in the robotics boom. This includes aggressive M&A and partnership strategies. In recent years, we’ve seen the likes of Hyundai acquire Boston Dynamics (to gain robotics IP and talent), Zebra Technologies acquire Fetch Robotics (to offer warehouse AMRs alongside its tracking solutions), and Teradyne acquire Universal Robots and Mobile Industrial Robots (positioning itself as a leader in collaborative and mobile robots for factories). In 2025, one of the most notable deals is reverse in nature: Symbotic’s acquisition of Walmart’s own robotics division as mentioned earlier, which actually strengthened a key partnership and added $5 billion to Symbotic’s project backlog. It’s a sign that the lines between vendors and customers can blur as robotics suppliers and end-users form symbiotic (no pun intended) alliances to accelerate deployment. Another trend is big tech and e-commerce firms investing directly in robotics startups to secure technology advantages – Amazon’s Industrial Innovation Fund has stakes in several robotics companies, and Microsoft, Nvidia, and Google have all funded humanoid or AI-robotics ventures.

For corporate strategists, a key consideration is go-to-market approach: many robotics firms are shifting to “robots-as-a-service” models, offering subscription or leasing options that lower upfront costs for customers. This not only removes a barrier to adoption for clients (turning CapEx into OpEx), but also provides vendors with recurring revenue and closer customer relationships. For example, some warehouse operators now opt for “warehouse automation as a service” – essentially paying per throughput or uptime, rather than buying hardware outright. Strategic partnerships are forming around these models, with financing firms or banks sometimes teaming up to fund the equipment while the robotics company manages service.

Market size forecasts consistently predict robust growth ahead: one analysis expects the global robotics industry to more than double from ~$90 billion in 2024 to over $200 billion by 2030. With such outlook, it’s no surprise that corporations are making robotics a pillar of their strategy – whether by investing in internal automation (like Tesla’s push for advanced manufacturing or Foxconn’s continued automation of electronics assembly), or by building product lines around robotics for sale. Every indication is that robotics in 2025 is at the start of an S-curve – early movers are locking in advantages, and latecomers may find it hard to catch up.

Labour Dynamics: Augmenting, Not Replacing, the Workforce

Perhaps the most consequential aspect of the robotics tipping point in 2025 is how it is reshaping the nature of work. Initially, the narrative around robots was dominated by fears of job losses and “human vs. machine” scenarios. Now, a more nuanced reality has emerged in leading firms: robots are being positioned as tools to augment human workers, taking over menial tasks and enabling people to focus on higher-skill, more creative or interpersonal roles. This shift in messaging and implementation is partly to allay public concern, but it’s also driven by necessity – in many economies, there simply aren’t enough workers to fill all the necessary roles, so automation is helping bridge the gap.

A key driver is the global labour shortage in manufacturing and logistics. As the IFR reports, demographic trends have led to workforce declines in countries like Japan, Germany, South Korea, China, and even the United States. A growing cohort of experienced baby-boomer employees are retiring, and younger generations are often less inclined to take up repetitive factory or warehouse jobs. The result: employers struggle to recruit for roles that are physically taxing or seen as undesirable. Robots present a solution to “fill gaps when and where needed”, especially as new collaborative and mobile robots make it easier to deploy automation flexibly. Notably, many companies deploying robots do so because they cannot find sufficient labour, rather than as a direct cost-cutting replacement. Agility Robotics’ co-founder Jonathan Hurst, whose company is rolling out humanoid warehouse robots, stated it plainly: “It’s a job they can’t hire people for… It is a big, windowless, very noisy warehouse. It is a robotic job.”. By introducing their robot “Digit” to lift and carry totes, Agility’s clients (like Amazon) hope to relieve humans from extremely dull, isolating tasks that have high turnover, and instead use human talent for supervision and exceptions.

The augmentative approach is also evident in how roles are being redesigned. For example, rather than a warehouse picker walking 10 miles a day collecting items, that worker might become a robotic fleet operator, overseeing a group of autonomous mobile robots (AMRs) that do the legwork. One person can manage multiple robots, intervening only when they encounter an issue, thereby multiplying human productivity. In manufacturing, a single technician might manage several robotic cells via a control interface, rather than manually tending one machine – turning factory jobs into more of a monitoring and optimization role. This enhances job scope and often wages, since the worker’s responsibilities are upgraded. Surveys confirm that cobots are viewed as complementary: they handle the repetitive or strenuous tasks, while humans focus on tasks that require flexibility, problem-solving or craftsmanship. The frequently-cited phrase in 2025 boardrooms is that robots take on the “3D tasks” – jobs that are Dirty, Dangerous, or Dull – and thereby improve overall workplace conditions.

There is data to support a less pessimistic outlook on jobs. The World Economic Forum famously estimated that while automation may displace 85 million jobs by 2025, it will also create about 97 million new roles, especially in areas like AI, data analysis, robotics maintenance, and the green economy. We are indeed seeing this shift: for instance, Amazon has introduced tens of thousands of robots in its fulfilment centers but also states it has created hundreds of thousands of new human jobs in the process – roles in managing robotics systems, technical maintenance, and new customer service positions as the business expanded. In Australia, studies found workers saved up to 245 hours per year thanks to automation of routine tasks, time which can be redirected to more valuable work or even work-life balance improvements. In essence, the nature of work is evolving rather than simply eroding.

Companies know that to fully reap the benefits of robotics, they must bring their workforce along. Hence, reskilling and upskilling programs are a critical component of the 2025 robotics revolution. Over half of all employees will require significant reskilling by 2025 due to new technology adoption, according to WEF forecasts. Leading firms have begun partnering with educational institutions and online platforms to provide training in robotics operation, programming, and maintenance. Micro-credential courses in robotics and AI have proliferated. Some governments are also supporting this – for example, national initiatives to fund digital skills training or apprenticeships in automation technology. This investment in human capital helps ensure that the workforce can move up the value chain as robots take over basic tasks. From a corporate culture perspective, involving employees in automation plans (e.g. Toyota’s approach of “Autonomation with a human touch”) helps reduce fear and builds acceptance that robots are teammates, not threats.

None of this is to say the transition is without challenges. Change management is significant – companies often need to reorganise workflows to integrate robots effectively. There can be resistance or anxiety among staff, especially if communication is poor. And it’s true that certain roles will become obsolete; not every displaced worker will immediately find a higher-skilled role. However, what’s changing in 2025 is a greater emphasis on managing these transitions humanely and strategically. Businesses are being more transparent about their automation roadmaps and the opportunities for current employees. Some have even guaranteed that no employees will be laid off due to automation, instead retraining those whose jobs are automated. This approach pays off in loyalty and mitigates the risk of labour disputes. In the big picture, as the IFR succinctly put it, “by automating tedious tasks, human workers can focus on more interesting and higher-value tasks”. That captures the guiding philosophy of robotics in the workplace circa 2025.

The net outcome is likely a transition in the labour force composition: fewer people in manual, unskilled roles and more in skilled technical and supervisory roles. For policy makers and society, the goal is to ensure this transition is inclusive – hence the attention to retraining and education. Companies adopting robotics are at the forefront of this labour shift, and those that handle it well will not only avoid backlash but enjoy a more engaged, future-ready workforce. For investors, a company that balances automation with workforce development demonstrates both operational excellence and social responsibility, which can be indicative of sustainable long-term performance.

Overcoming Barriers: Why 2025 Accelerates Robotics Uptake

What has changed in 2025 that makes the commercial adoption of robotics so rapid? Several historical barriers to adoption have been lowered, turning what used to be difficult investment decisions into obvious ones. Understanding these changes is crucial for leaders evaluating robotics today:

- Cost and ROI: High upfront cost was long cited as the number one barrier to automation for many firms. Industrial robots in 2010 averaged around $46,000 each – a steep price for SMEs. By 2017 that average fell to $27,000, and projections put it near $10,000 by 2025. Whether or not it has reached that exact figure, the clear trend is that robot prices have fallen sharply while capabilities have risen. Lower-cost sensors, cheaper and more powerful computing (often leveraging smartphone supply chains), and higher production volumes have all contributed. Moreover, innovative business models like leasing and Robot-as-a-Service (RaaS) mean companies can automate with minimal upfront expenditure. They pay a monthly fee or per-output fee, turning automation into an operating expense that scales with usage. This dramatically improves the financial case. On top of that, automation often yields quick wins (as discussed in the ROI section) which build confidence. All these factors reduce the financial uncertainty – the question is no longer “can we afford to automate?” but “can we afford not to, given the fast payback and competitive gains?”.

- Technology Maturity: The past few years have seen leaps in AI, machine vision, and software that have effectively unlocked new robot applications. Tasks that were too complex for robots a decade ago – such as picking assorted consumer items, navigating busy environments, or cooperating safely with humans – are now feasible thanks to better AI algorithms and sensors. Robots today often come with out-of-the-box vision systems and pre-trained AI models enabling them to recognise objects or human gestures. For example, modern robots use analytical AI to optimise their motion based on sensor data, making them faster and more reliable in unstructured settings. Simulation and “physical AI” allow virtual training of robots, reducing programming effort. Even generative AI is being explored to let robots learn tasks from basic prompts, hinting at a future “ChatGPT moment” for robotics. In practical terms, a company in 2025 can deploy a robot cell far more easily than in 2015 – much of the integration and intelligence is handled by the vendor’s software. The interface for operators has also improved (often tablet-based, low-code programming), meaning you don’t need a PhD roboticist on staff to run them. Technical barriers like complexity and inflexibility are steadily eroding, encouraging wider uptake.

- Regulatory and Standards Evolution: Initially, regulations around safety, especially for collaborative scenarios, were a hurdle – companies feared liability if robots injured someone, and standards were lacking. By 2025, clear ISO standards for robot safety and collaborative operation are in place, and many countries have updated their labour and safety regulations to accommodate robots working alongside humans. For instance, Taiwan revised its industrial robot safety standards in 2018 with input from companies like TSMC, and similar regulatory modernization has occurred across Europe, North America, and Asia. Furthermore, governments are now actively incentivising automation adoption. In the United States, new legislation in mid-2025 introduced enhanced tax credits for investments in automation equipment. This allows manufacturers to write off robotic purchases more quickly, directly improving the ROI. Other nations have grant programs or industry 4.0 subsidies to encourage especially small and mid-sized enterprises to automate. In sum, the policy climate in 2025 is far more supportive: rather than viewing automation as a threat to jobs, many governments see it as essential to productivity and are removing red tape (for example, around autonomous vehicle testing or drone deliveries) to accelerate progress. A notable example is the U.S. developing a National Robotics Strategy to ensure it stays competitive with nations like China that heavily promote robotics. All this gives companies greater confidence that if they invest in robots now, the regulatory environment will back them up rather than hinder them.

- Geopolitical and Macro Drivers: Finally, broad geopolitical currents are giving an extra push to robotics in 2025. Tensions and trade restrictions – particularly between Western countries and China – are prompting reassessments of supply chains. There is a strategic desire in the U.S. and Europe to reduce reliance on foreign manufacturing by boosting domestic automated production. China for its part is doubling down on robotics to mitigate rising wages and maintain manufacturing dominance; Chinese companies are among the largest robotics funders and adopters now, often with government backing. One Chinese humanoid robot venture raised $300M in 2025, showing that “Chinese investors are willing to commit large sums to long-horizon robotics plays” just as Western ones are. This race in robotics investment is somewhat reminiscent of the space race or the AI race – it creates an impetus for companies and countries not to be left behind. Additionally, events like the COVID-19 pandemic and the war in Ukraine underscored the fragility of globalised labour networks and the value of automation for resilience. Many firms experienced labour shortages or restrictions that automation could alleviate (e.g. robots kept some factories and warehouses running with minimal staff during lockdowns). And with inflation and labour costs climbing in many regions in 2024–25, automation is seen as a hedge against wage pressures. In short, the world situation has made automation not just a matter of efficiency but of strategic autonomy and continuity. Companies now frame robotics adoption as part of their risk management against supply disruptions and workforce unavailability.

All these factors combined mean that barriers which once slowed robotics adoption are being overcome, making 2025 a breakout year. The conversation has shifted from “What’s holding robots back?” to “How fast can we implement them responsibly?” Businesses that may have taken a “wait and see” approach five years ago are now realising that waiting means falling behind. As the cost-benefit calculus has flipped in favour of robotics, those who act decisively in 2025 will capture early mover advantages – in efficiency, in expertise, and in market share – that could compound for years to come. It truly is a tipping point: the question is no longer ifrobotics will transform commercial operations, but when and by whom. And the answer increasingly appears to be now, by those with the vision to invest.

Forward-Looking Perspectives for Investors and Leaders

In 2025, the commercialisation of robotics has reached an inflection point that promises to reshape business in profound ways. For investors and corporate leaders, this presents both an opportunity and an imperative. The opportunity is clear – companies that harness robotics effectively can unlock margin expansion, secure competitive advantages in speed and quality, and create new revenue streams in burgeoning markets. The imperative is that failing to engage with this wave of automation could leave firms at a structural disadvantage, akin to laggards in earlier tech revolutions.

Crucially, the narrative around robotics has matured. It’s no longer about flashy demos or speculative ideas; it’s about tangible outcomes and strategies. We see margin improvement in financial statements, not just theory. We see multi-year contracts between household-name corporations and robotics providers, underlining that automation is a boardroom-level strategy. We see a rich ecosystem of startups and investors ensuring a pipeline of innovation, while established companies use their scale to deploy robotics globally. And encouragingly, we see the integration of sustainability and workforce considerations, which suggests this transformation can be both profitable and responsible.

Looking beyond 2025, we can anticipate an acceleration of these trends. The market forecasts and capital commitments point to a robotics sector that will likely double or triple in size over the next decade.Emerging players in areas like AI-driven robots, humanoids, and vertical-specific automation could become the blue-chips of tomorrow. We may also witness a convergence of technologies – AI, IoT, 5G, and cloud computing all combining with robotics to enable even more autonomous, adaptable systems. For example, robots connected to cloud AI could learn collectively across fleets, improving at a pace individual deployments never could. Such developments could lead to productivity gains we can barely imagine today.

Of course, challenges will remain. Competition will increase as more players enter the field – potentially driving consolidation or price pressure on robotics providers. Skills shortages could shift from manual labour to robotics technicians if training doesn’t keep up. Regulators will have to continue evolving frameworks around areas like autonomous vehicles, drone delivery, and AI ethics in robotics. And companies will need to carefully manage the human side of automation to maintain public trust and employee morale. But given the momentum seen in 2025, these challenges appear surmountable with thoughtful strategy and collaboration between industry, governments, and educational institutions.

In conclusion, 2025 is indeed a tipping point year for the commercialisation of robotics. It’s the year automation graduated from a supporting role to a starring role in the story of business transformation. For those in the boardroom and the investment committee, the message is to lean in and engage with this trend. Whether it’s investing in the right technologies, forging partnerships, or reimagining business models around automation, the actions taken now will determine who thrives in the increasingly automated economy of the late 2020s and beyond. The robots have arrived – and they are ready to work. It’s up to us to put them to their highest and best use, for the benefit of enterprise value, customers, employees, and society at large.

editor@rbnpress.com

Disclaimer:

This overview is for information only and does not constitute investment advice or a recommendation to buy or sell any securities.