Nightfood Holdings Accelerates Robotics-First Hospitality Strategy with $31M Hotel Acquisition

The 155-room Holiday Inn in Victorville, CA, becomes a live Robotics-as-a-Service (RaaS) innovation hub, positioning Nightfood as a leader in AI-powered hotel automation.

Image Courtesy: Public Domain

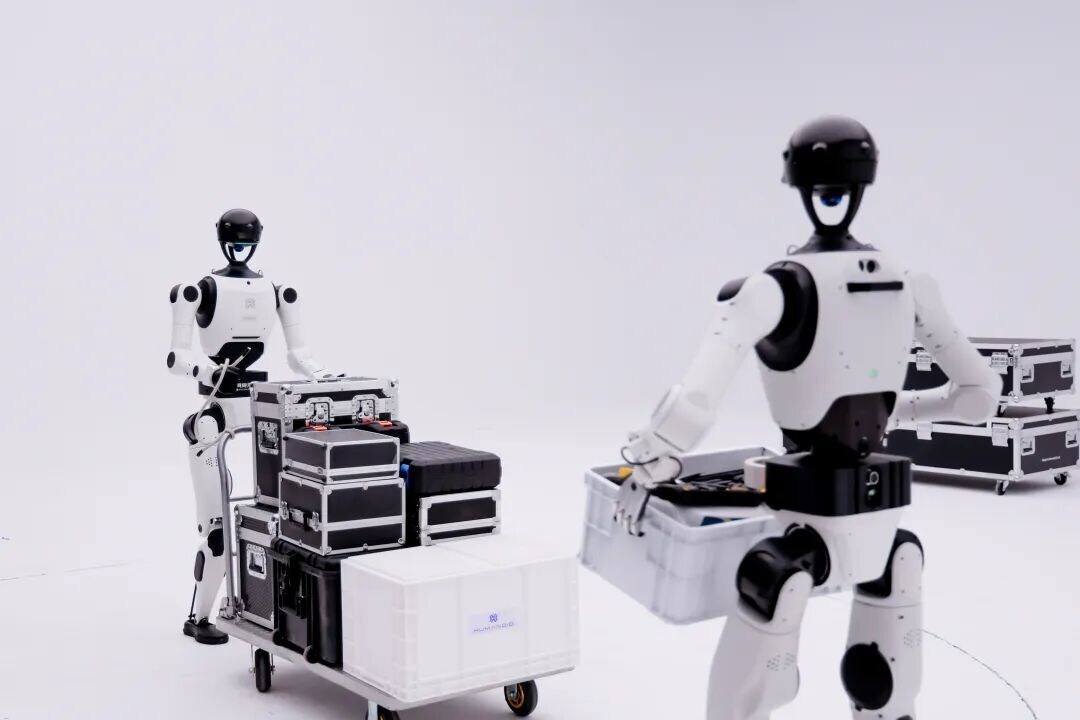

The robotics revolution is transforming industries at an unprecedented pace, with automation and artificial intelligence (AI)-powered systems becoming integral to operations across manufacturing, health care, retail and logistics. Perhaps nowhere is this transformation more visible or more promising than in the hospitality sector, where robots and AI are revolutionizing everything from guest check-in and room service to housekeeping and concierge services. Leading this hospitality robotics transformation is Nightfood Holdings Inc. (OTCQB: NGTF) (Profile), which has strategically pivoted to become a robotics-first company by completing its first hotel acquisition, establishing a live deployment site that serves as a real-world showcase for robotics and AI-powered automation in hospitality operations. With a second property acquisition already underway, Nightfood is positioning itself at the forefront of the industry's technological evolution, demonstrating how robotics can seamlessly integrate into traditional hotel management to deliver superior guest experiences while optimizing operational performance across multiple properties. Nightfood is strengthening its place in a group of companies, including NVIDIA Corp. (NASDAQ: NVDA), Meta Platforms Inc. (NASDAQ: META), Advanced Micro Devices Inc. (NASDAQ: AMD) and Broadcom Inc. (NASDAQ: AVGO), that are making their mark as leaders in the AI and robotics space.

- Nightfood Holdings has officially closed on its first hotel acquisition, a 155-room Holiday Inn in Victorville, California, for $31 million.

- The Victorville hotel is not only an acquisition, it's a live Robotics-as-a-Service (RaaS) innovation hub.

- NGTF is steadfastly positioning itself as a "robotics-first company," with hospitality serving as the initial launchpad.

- The company's strategy of combining real estate ownership with robotics innovation gives Nightfood both financial stability and technological relevance.

- Nightfood's acquisition approach also serves a critical regulatory function by helping the company advance its SEC audits and uplisting ambitions.

A Robotic and AI Revolution

The hospitality sector is experiencing a pronounced shift as automation and AI-powered systems redefine traditional service paradigms. According to a Business Research report, the global robotics market focused on hospitality was valued at approximately $0.72 billion in 2024 and is projected to surge to $5.56 billion by 2033, growing at an impressive compound annual growth rate of 25.5%. This uptick reflects much more than novelty; it underscores the escalating need for innovation in a labor-intensive industry grappling with staffing shortages and customer expectations. Hotels adopting robotic solutions for concierge duties, room service and cleaning are not only gaining operational efficiencies but also improving safety standards in the post-pandemic era.

Business Research noted that the hospitality service robot market is expanding very quickly as the hospitality sector becomes revolutionized through automation and AI. "The robots are meant to improve the guests' experience, increase operational efficiency and minimize labor expenses for hotels, restaurants and travel agencies," the report noted. "The robots carry out activities like concierge services, room service, cleaning and customer interaction.

"Improvements in AI, machine learning and IoT have allowed robots to engage with visitors, respond to voice commands and move around complicated spaces independently," the report continued. "The increasing need for contactless services, especially in the post-pandemic era, has further driven their use. Hotels and restaurants more and more employ service robots to maintain hygiene, automate processes and improve guest satisfaction."

Nightfood Holding is an emerging robotics company entering the $170-plus billion global service robotics market by embedding automation directly into hotel operations, one of the most labor-intensive and cost-sensitive industries.

A Strategic Entry Point

Nightfood Holdings has officially closed on its first hotel acquisition, a 155-room Holiday Inn in Victorville, California, for $31 million. This deal marked the company's initial step in transforming itself into a hospitality technology and automation player, with a second acquisition already nearing completion. This transaction was executed through a share exchange agreement, emphasizing the company's asset-light, equity-based approach to expansion.

The acquisition is more than a real estate investment. Nightfood's leadership sees it as a foundational milestone of its AI-driven hospitality platform, positioning NGTF at the nexus of automation and traditional hotel ownership. The Victorville property will serve as a live innovation site, where technology, branding, and operations converge.

As the first owned property of NGTF, Victorville offers a real-world testing ground to refine robotics and validate automation models. Moreover, it anchors the company's strategy of pairing recurring robotics revenue with long-term property appreciation, creating a resilient dual-revenue model that aligns innovation with asset value.

Robotics in Action at Victorville

The Victorville hotel is not only an acquisition, it's a live Robotics-as-a-Service (RaaS) innovation hub. Initial robots are already operational. Most notably, the company has already deployed Skytech's Laundry Helper robot in back-of-house operations. The company plans to expand robotics into housekeeping, food service and front-of-house guest amenities, effectively creating a prototype "smart hotel."

This is where Nightfood's robotics ambitions meet operational reality. Deploying automation across multiple service verticals in a live property allows the company to benchmark performance, refine protocols and attract future customers that are looking for validated, end-to-end automation solutions. As CEO Jimmy Chan said: "Victorville is our first automation blueprint. It's where we test, learn and set the bar for the next generation of smart hotel operations."

This real-world testing also acts as a runway for licensing. Once proven, Nightfood plans to license its robotic systems to third-party hotels, creating a scalable business model to generate recurring RaaS income anchored in proven deployment experience.

Robotics-First with Hospitality Launchpad

Nightfood Holdings is steadfastly positioning itself as a "robotics-first company," with hospitality serving as the initial launchpad. The company's focus extends beyond mere automation; it aims to rewrite how hotels operate by employing AI-powered robots for tasks that are repetitive, labor-intensive or injury-prone.

From front-desk operations to back-of-house functions such as laundry and food delivery, Nightfood's robotic integrations are designed to enhance efficiency, reliability and safety, freeing human staff for more productive and guest-focused roles. This transformative approach reflects an understanding that as labor costs rise and workforce shortages persist, service automation is not just an option, it's a necessity.

Nightfood is meeting that service-robotics-within-hospitality need with its RaaS platform, making rapid deployment, scalability and recurring revenue central to its mission. With the Victorville property serving as a live deployment site, the company is able to collect operational data and customer feedback in real time, allowing the robotics systems to evolve continuously. This iterative development model addresses one of the biggest hurdles in robotics adoption: real-world performance. By owning and operating the environment where its robots function, Nightfood gains flexibility that is unavailable to traditional robotics startups that depend on third-party testing.

Looking ahead beyond hospitality, Nightfood is poised for cross-industry expansion. Tasks deemed repetitive, labor-intensive or even dangerous can become automation targets at scale. The company has indicated interest in extending its RaaS platform into sectors such as healthcare, senior living and manufacturing. With an asset-backed model and experience in real-world deployment, Nightfood is building a strong foundation to diversify into any industry with similar automation demands.

Asset Ownership Meets Innovation

Nightfood's unique strategy of combining real estate ownership with robotics innovation is designed to give the company both financial stability and technological relevance. By acquiring income-producing hotel assets, the company secures hard value on its balance sheet. At the same time, each property becomes a testbed for live robotic deployments, creating a synergistic model where innovation directly enhances asset performance. Hotels are not just financial holdings but working laboratories for automation, enabling Nightfood to refine systems in real-world conditions

This dual strategy reflects a broader market trend where robotics and real estate increasingly intersect. By pairing property ownership with cutting-edge technology, Nightfood is positioned to generate multiple streams of value: appreciation from the hotel assets themselves and recurring subscription-based revenue from RaaS. This model derisks the business by ensuring that if robotics adoption is slower than expected, the company still benefits from hotel cash flows and property appreciation. Conversely, if robotics deployments scale rapidly, the company captures both operational efficiencies and licensing revenues.

Owning the hotels also provides Nightfood with control and flexibility in how automation is rolled out. Many robotics firms struggle to gain traction because they rely on third-party operators for testing, which can create friction and limit deployment speed. By operating its own hotels, Nightfood bypasses these barriers, accelerating the cycle of innovation and adoption. This vertical integration could become a model for other industries where real estate and robotics can align to unlock efficiency and long-term growth.

SEC Audits and Uplisting in Motion

Nightfood's acquisition strategy also serves a critical regulatory function by helping the company advance its SEC audits and uplisting ambitions. With its first property closed and audited, Nightfood is laying the groundwork for greater compliance and transparency, key requirements for attracting institutional investors and qualifying for a national exchange listing. For small-cap companies, uplisting to exchanges such as NASDAQ or NYSE American represents a pivotal step, broadening access to capital markets and increasing shareholder liquidity.

The company has been transparent in framing the Victorville acquisition as both a financial milestone and a compliance milestone. Audited financials tied to tangible hotel assets bolster credibility and create a stronger foundation for future filings. As Nightfood progresses toward completing its second acquisition, this dual momentum accelerates its trajectory toward uplisting eligibility, enhancing investor confidence and positioning the company for broader exposure in public markets.

For investors, this transparency signals discipline and long-term focus. The combination of owning revenue-generating assets, deploying transformative robotics and advancing toward a higher-tier exchange listing makes Nightfood a unique proposition in the small-cap space. The pursuit of uplisting is not just about optics; it reflects the company's intention to scale responsibly and maintain governance standards on par with larger, more established peers. This dual commitment to both innovation and compliance sets the stage for sustainable growth in an industry where many competitors struggle.

Leaders Reshape AI for the Future

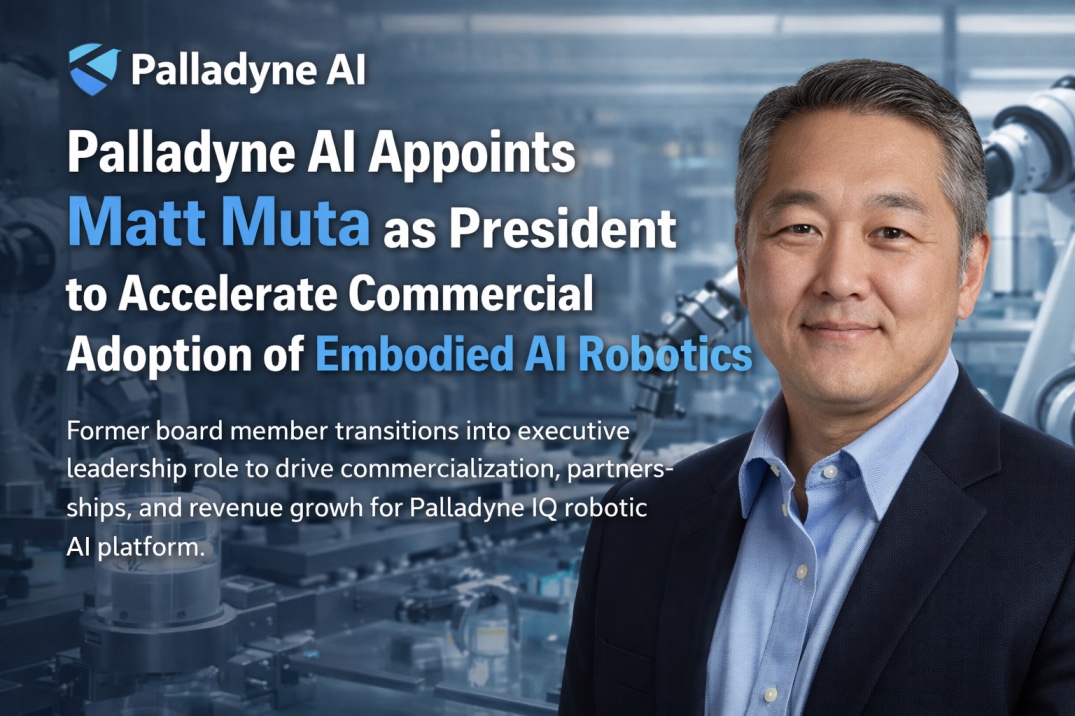

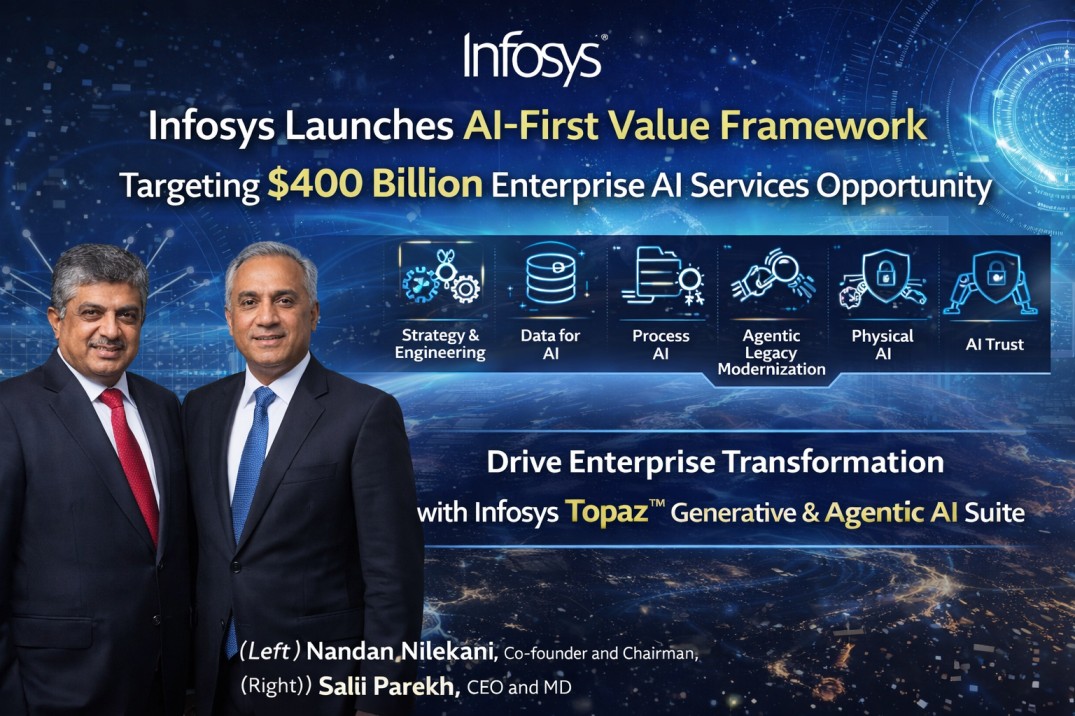

The global race to power and provide artificial intelligence is accelerating as leading players in the AI space make major moves to support the technology in their respective sectors. These advancements mark a pivotal moment in the shift toward systems built for the high-tech AI and robotics era across an array of industries.

NVIDIA Corp. (NASDAQ: NVDA) is reporting that leading global enterprises have adopted its NVIDIA RTX PRO9TM) servers. The servers are a new category of enterprise data center infrastructure powered by the RTX PRO 6000 Blackwell Server Edition GPU. According to the company, Disney, Foxconn, Hitachi Ltd., Hyundai Motor Group, Lilly, SAP and TSMC are among the first to adopt the servers to accelerate AI, design and simulation applications. "The age of AI has arrived — and enterprises can no longer rely on classical servers alone. They must rearchitect for AI," said NVIDIA founder and CEO Jensen Huang.

Meta Platforms Inc. (NASDAQ: META) has introduced V-JEPA 2, a new world model that achieves state-of-the art visual understanding and prediction in the physical world, improving the physical reasoning of AI agents. In the announcement, the company noted that "physical reasoning is essential to building AI agents that can operate in the physical world, and to achieving advanced machine intelligence." Meta also released three new benchmarks to evaluate how well existing models can reason about the physical world from video.

Advanced Micro Devices Inc. (NASDAQ: AMD), along with key partners, is delivering an open standard AI Rack infrastructure with an up to 128-GPU rack in market built around AMD Instinct(TM) MI350 series GPUs, 5th Gen EPYC(TM) CPUs and Pensando(TM) Pollara 400 NICs. In the announcement, the company noted that Agentic AI represents the next wave of AI transformation, one where intelligent agents not only automate tasks but drive complex workflows, innovation and decision-making across industries. These agents need high-performance CPUs, and AMD is uniquely positioned to power every layer of this stack, all underpinned by open, flexible and programmable infrastructure designed for modern AI.

Broadcom Inc. (NASDAQ: AVGO) has announced that VMware Private AI Services will become a standard component of VMware Cloud Foundation 9.0, making VCF an AI native platform and accelerating developer productivity. The company noted that the newest innovations for AI workloads and AI developers are designed to help speed enterprise adoption of private AI as a service. "Today, nine of the top 10 Fortune 500 companies have committed to VCF, with customers worldwide having licensed more than 100 million cores of VCF," reported the company. With VCF 9.0 now available, customers can adopt a unified, AI native platform for secure, modern private cloud infrastructure at scale.

Strategic announcements and approaches such as these reflect the broader momentum sweeping across the AI and robotic landscape, where advances of all kinds are converging to unlock new possibilities. Together, they signal that the future will be defined not by individual breakthroughs but by the collective progress of strategies and steps that reshape and redefine how industries innovate and compete.